Question: 4. a. Thomas is a System Analyst aged 40 and plans to retire in 15 years. His current portfolio includes $7 million cash and mutual

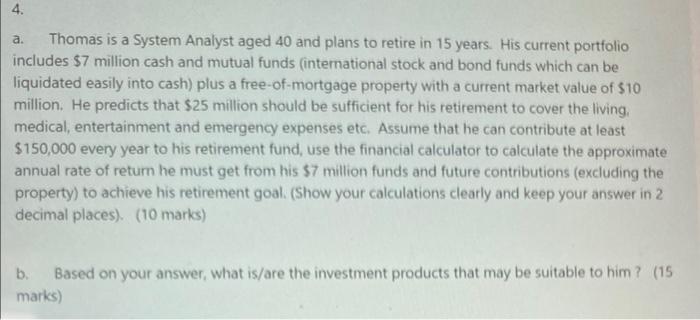

4. a. Thomas is a System Analyst aged 40 and plans to retire in 15 years. His current portfolio includes $7 million cash and mutual funds (international stock and bond funds which can be liquidated easily into cash) plus a free-of-mortgage property with a current market value of $10 million. He predicts that $25 million should be sufficient for his retirement to cover the living, medical, entertainment and emergency expenses etc. Assume that he can contribute at least $150,000 every year to his retirement fund, use the financial calculator to calculate the approximate annual rate of retum he must get from his 57 million funds and future contributions (excluding the property) to achieve his retirement goal (Show your calculations clearly and keep your answer in 2 decimal places). (10 marks) b. Based on your answer, what is/are the investment products that may be suitable to him? (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts