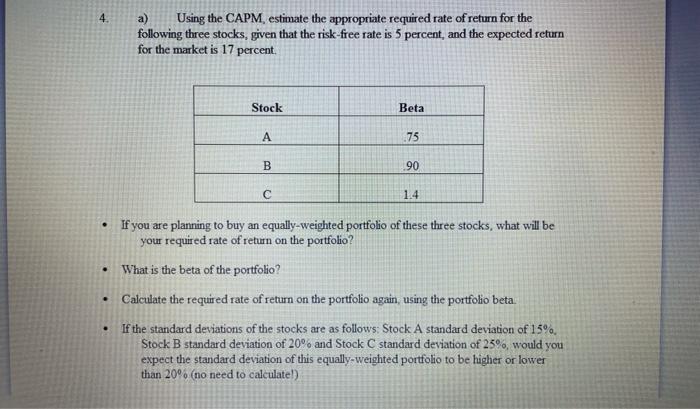

Question: 4. a) Using the CAPM estimate the appropriate required rate of return for the following three stocks, given that the risk-free rate is 5 percent,

4. a) Using the CAPM estimate the appropriate required rate of return for the following three stocks, given that the risk-free rate is 5 percent, and the expected return for the market is 17 percent. Stock Beta A 75 B 90 1.4 If you are planning to buy an equally-weighted portfolio of these three stocks, what will be your required rate of return on the portfolio? What is the beta of the portfolio? Calculate the required rate of return on the portfolio again, using the portfolio beta If the standard deviations of the stocks are as follows: Stock A standard deviation of 15% Stock B standard deviation of 20% and Stock C standard deviation of 25%, would you expect the standard deviation of this equally-weighted portfolio to be higher or lower than 20% (no need to calculate!)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts