Question: 4.) a.) What the difference between systematic risk and unsystematic risk? Investors should care only about what type of risk, assuming they are creating a

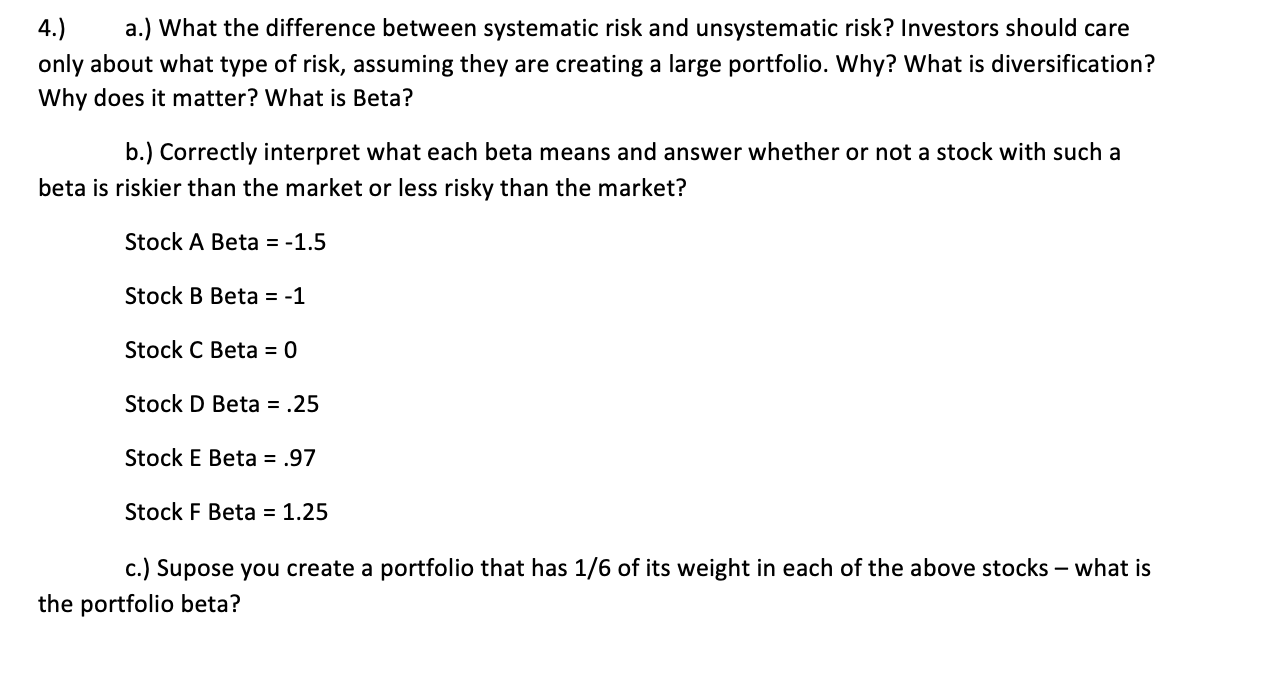

4.) a.) What the difference between systematic risk and unsystematic risk? Investors should care only about what type of risk, assuming they are creating a large portfolio. Why? What is diversification? Why does it matter? What is Beta? b.) Correctly interpret what each beta means and answer whether or not a stock with such a beta is riskier than the market or less risky than the market? Stock A Beta = -1.5 Stock B Beta = -1 Stock C Beta = 0 Stock D Beta = .25 Stock E Beta = .97 Stock F Beta = 1.25 c.) Supose you create a portfolio that has 1/6 of its weight in each of the above stocks - what is the portfolio beta? 4.) a.) What the difference between systematic risk and unsystematic risk? Investors should care only about what type of risk, assuming they are creating a large portfolio. Why? What is diversification? Why does it matter? What is Beta? b.) Correctly interpret what each beta means and answer whether or not a stock with such a beta is riskier than the market or less risky than the market? Stock A Beta = -1.5 Stock B Beta = -1 Stock C Beta = 0 Stock D Beta = .25 Stock E Beta = .97 Stock F Beta = 1.25 c.) Supose you create a portfolio that has 1/6 of its weight in each of the above stocks - what is the portfolio beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts