Question: 4. (a) You are offered a resource sector project that will require initial exploration expenditure. You have estimated the probabilities of finding, and subsequently developing,

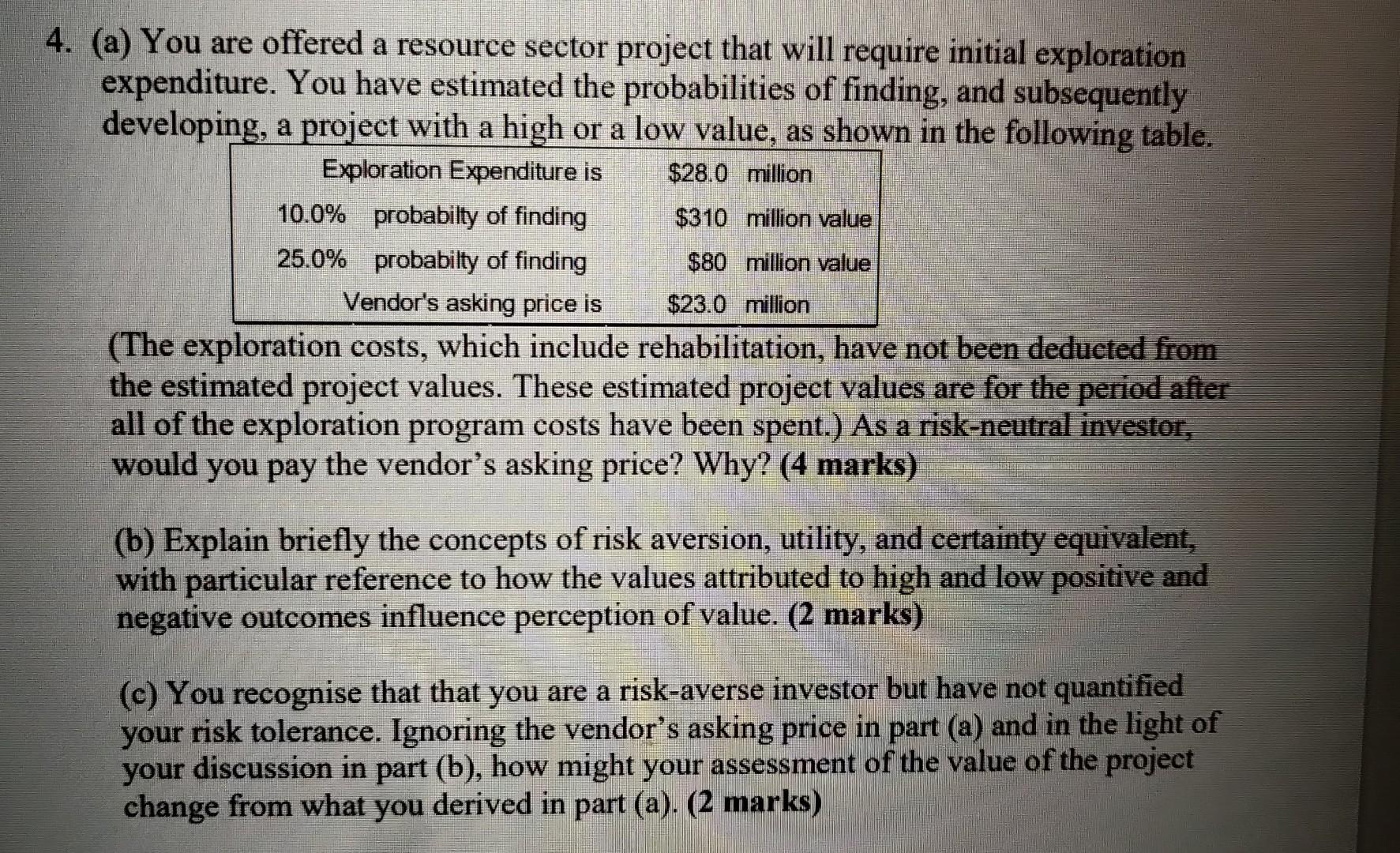

4. (a) You are offered a resource sector project that will require initial exploration expenditure. You have estimated the probabilities of finding, and subsequently developing, a project with a high or a low value, as shown in the following table. Exploration Expenditure is $28.0 million 10.0% probabilty of finding probabilty of finding Vendor's asking price is $310 million value $80 million value 25.0% $23.0 million (The exploration costs, which include rehabilitation, have not been deducted from the estimated project values. These estimated project values are for the period after all of the exploration program costs have been spent.) As a risk-neutral investor, would you pay the vendor's asking price? Why? (4 marks) (b) Explain briefly the concepts of risk aversion, utility, and certainty equivalent, with particular reference to how the values attributed to high and low positive and negative outcomes influence perception of value. (2 marks) risk (c) You recognise that that you are a risk-averse investor but have not quantified your risk tolerance. Ignoring the vendor's asking price in part (a) and in the light of your discussion in part (b), how might your assessment of the value of the project change from what you derived in part (a). (2 marks) 4. (a) You are offered a resource sector project that will require initial exploration expenditure. You have estimated the probabilities of finding, and subsequently developing, a project with a high or a low value, as shown in the following table. Exploration Expenditure is $28.0 million 10.0% probabilty of finding probabilty of finding Vendor's asking price is $310 million value $80 million value 25.0% $23.0 million (The exploration costs, which include rehabilitation, have not been deducted from the estimated project values. These estimated project values are for the period after all of the exploration program costs have been spent.) As a risk-neutral investor, would you pay the vendor's asking price? Why? (4 marks) (b) Explain briefly the concepts of risk aversion, utility, and certainty equivalent, with particular reference to how the values attributed to high and low positive and negative outcomes influence perception of value. (2 marks) risk (c) You recognise that that you are a risk-averse investor but have not quantified your risk tolerance. Ignoring the vendor's asking price in part (a) and in the light of your discussion in part (b), how might your assessment of the value of the project change from what you derived in part (a). (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts