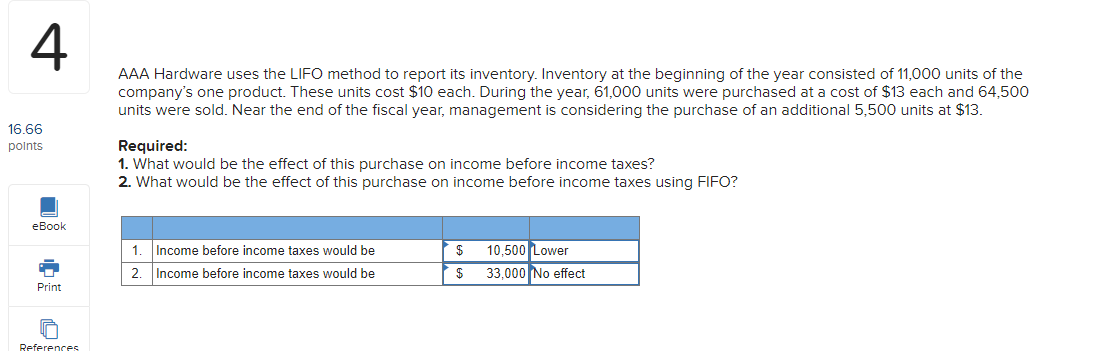

Question: 4 AAA Hardware uses the LIFO method to report its inventory. Inventory at the beginning of the year consisted of 11,000 units of the company's

4 AAA Hardware uses the LIFO method to report its inventory. Inventory at the beginning of the year consisted of 11,000 units of the company's one product. These units cost $10 each. During the year, 61,000 units were purchased at a cost of $13 each and 64,500 units were sold. Near the end of the fiscal year, management is considering the purchase of an additional 5,500 units at $13. 16.66 points Required: 1. What would be the effect of this purchase on income before income taxes? 2. What would be the effect of this purchase on income before income taxes using FIFO? eBook 1 Income before income taxes would be Income before income taxes would be $ $ 10,500 Lower 33,000 No effect 2. Print References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts