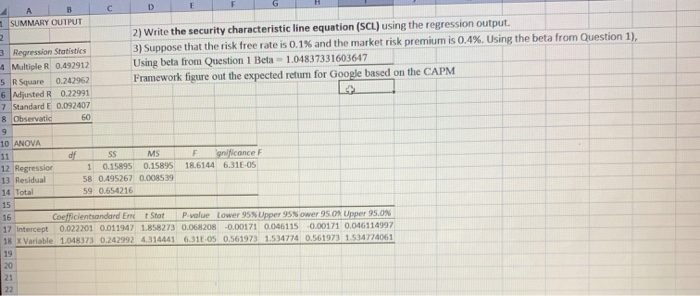

Question: 4 AB 1 SUMMARY OUTPUT 2) Write the security characteristic line equation (SCL) using the regression output. 3) Suppose that the risk free rate is

4 AB 1 SUMMARY OUTPUT 2) Write the security characteristic line equation (SCL) using the regression output. 3) Suppose that the risk free rate is 0.1% and the market risk premium is 0.4%. Using the beta from Question 1), Using beta from Question 1 Beta - 1.04837331603647 Framework figure out the expected return for Google based on the CAPM 3 Regression Statistics 4 Multiple R 0.492912 5 RSquare 0.242962 6 Adjusted R 0.22991 7 Standard E 0.092407 8 Observatic 60 df 10 ANOVA 11 12 Regression 13 Residual 14 Total F onconce 18.6144 6,31E-05 SS MS 1 0.15895 0.15895 58 0.495267 0.008539 59 0.654216 16 Coefficientsandard Eme Stat P value Lower 95 Upper 95% ower 95.ON Upper 95.0% 17 Intercept 0.022201 0.011947 1.858273 0.068208 0.00171 0.046115 0.00171 0.046114997 18 x Variable 1.048373 0.242992 4.314441 6.31E-OS 0.561973 1.534774 0.561973 1534774061

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts