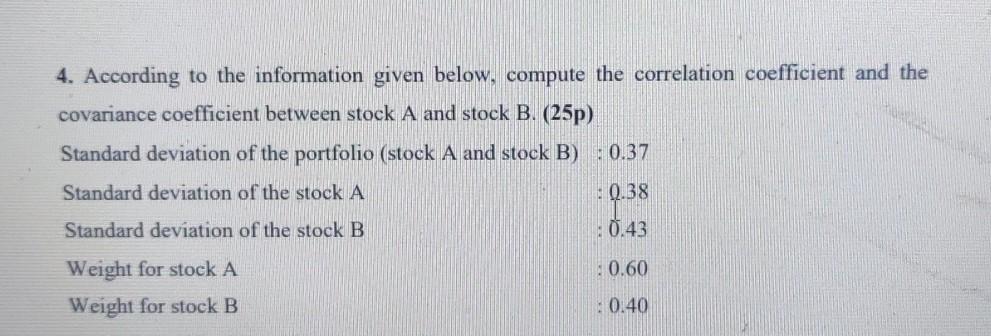

Question: 4. According to the information given below, compute the correlation coefficient and the covariance coefficient between stock A and stock B. (25p) Standard deviation of

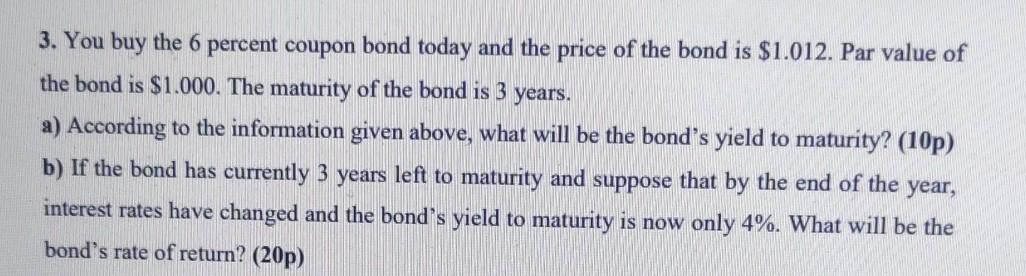

4. According to the information given below, compute the correlation coefficient and the covariance coefficient between stock A and stock B. (25p) Standard deviation of the portfolio (stock A and stock B) : 0.37 Standard deviation of the stock A 10.38 Standard deviation of the stock B : 0.43 : 0.60 Weight for stock A Weight for stock B : 0.40 3. You buy the 6 percent coupon bond today and the price of the bond is $1.012. Par value of the bond is $1.000. The maturity of the bond is 3 years. a) According to the information given above, what will be the bond's yield to maturity? (10p) b) If the bond has currently 3 years left to maturity and suppose that by the end of the year, interest rates have changed and the bond's yield to maturity is now only 4%. What will be the bond's rate of return? (20p)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts