Question: 4. Acor is planning to acquire a new machine, which would cost $1,750,000. The acquisition will be financed through a finance lease agreement, which has

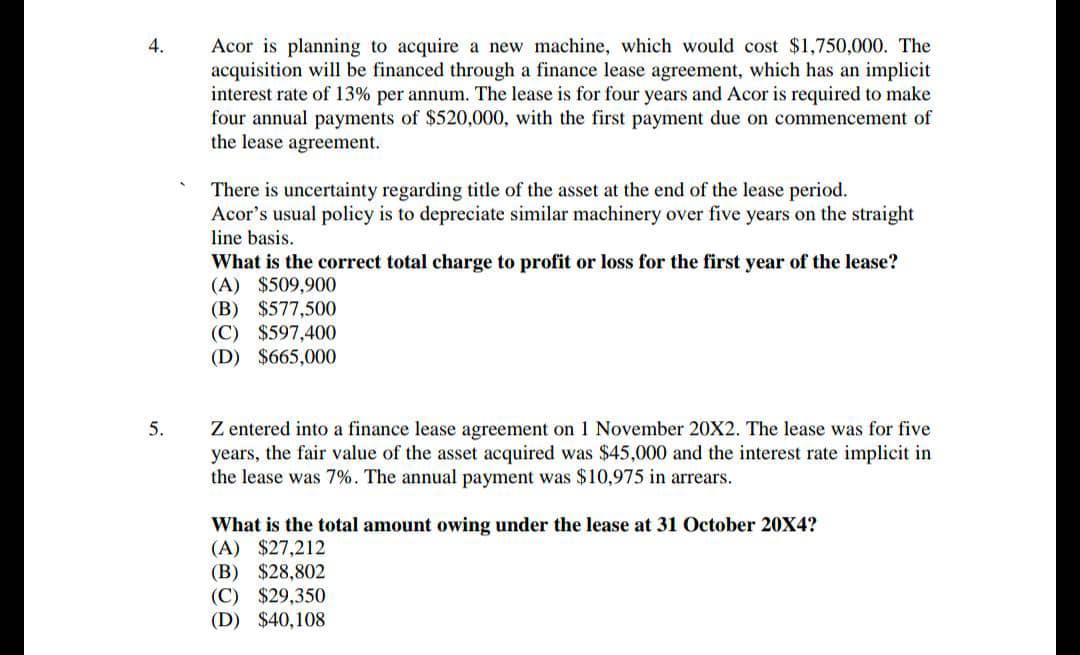

4. Acor is planning to acquire a new machine, which would cost $1,750,000. The acquisition will be financed through a finance lease agreement, which has an implicit interest rate of 13% per annum. The lease is for four years and Acor is required make four annual payments of $520,000, with the first payment due on commencement of the lease agreement. There is uncertainty regarding title of the asset at the end of the lease period. Acor's usual policy is to depreciate similar machinery over five years on the straight line basis. What is the correct total charge to profit or loss for the first year of the lease? (A) $509,900 (B) $577,500 (C) $597,400 (D) $665,000 5. Z entered into a finance lease agreement on 1 November 20X2. The lease was for five years, the fair value of the asset acquired was $45,000 and the interest rate implicit in the lease was 7%. The annual payment was $10,975 in arrears. What is the total amount owing under the lease at 31 October 20X4? (A) $27,212 (B) $28,802 (C) $29,350 (D) $40,108

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts