Question: 4. Agnes' Jam and Marmalade (AJM) also needs to replace a completely worn out packaging machine. The machine packs jam and marmalade jars into carton

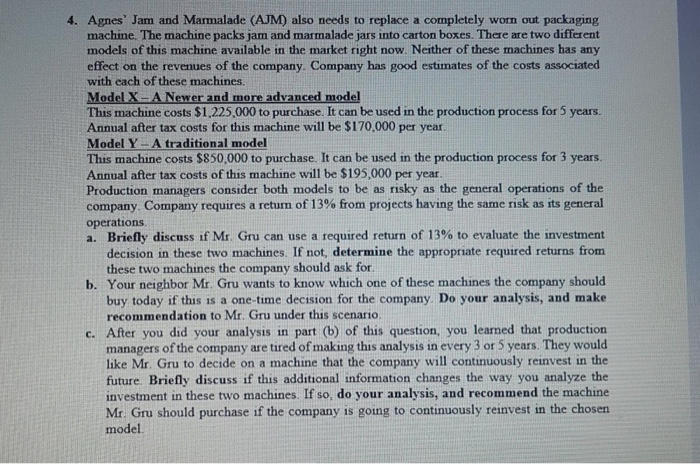

4. Agnes' Jam and Marmalade (AJM) also needs to replace a completely worn out packaging machine. The machine packs jam and marmalade jars into carton boxes. There are two different models of this machine available in the market right now. Neither of these machines has any effect on the revenues of the company. Company has good estimates of the costs associated with each of these machines Model X-A Newer and more advanced model This machine costs $1.225.000 to purchase. It can be used in the production process for 5 years Annual after tax costs for this machine will be $170,000 per year. Model Y-A traditional model This machine costs $850,000 to purchase. It can be used in the production process for 3 years. Annual after tax costs of this machine will be $195,000 per year. Production managers consider both models to be as risky as the general operations of the company Company requires a return of 13% from projects having the same risk as its general operations a. Briefly discuss if Mr. Gru can use a required return of 13% to evaluate the investment decision in these two machines. If not, determine the appropriate required returns from these two machines the company should ask for b. Your neighbor Mr. Gru wants to know which one of these machines the company should buy today if this is a one-time decision for the company. Do your analysis, and make recommendation to Mr. Gru under this scenario. After you did your analysis in part (b) of this question, you learned that production managers of the company are tired of making this analysis in every 3 or 5 years. They would like Mr. Gru to decide on a machine that the company will continuously reinvest in the future. Briefly discuss if this additional information changes the way you analyze the investment in these two machines. If so, do your analysis, and recommend the machine Mr. Gru should purchase if the company is going to continuously reinvest in the chosen model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts