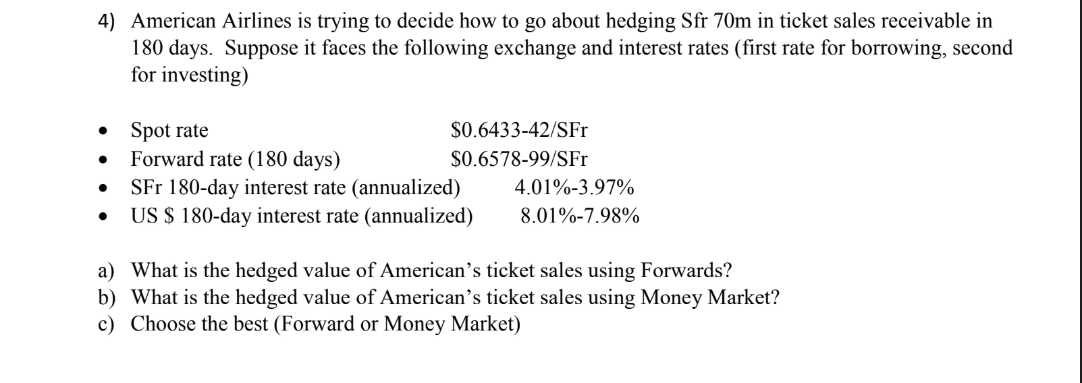

Question: 4) American Airlines is trying to decide how to go about hedging Sfr 70m in ticket sales receivable in 180 days. Suppose it faces the

4) American Airlines is trying to decide how to go about hedging Sfr 70m in ticket sales receivable in 180 days. Suppose it faces the following exchange and interest rates (first rate for borrowing, second for investing) Spot rate $0.6433-42/SFr Forward rate (180 days) $0.6578-99/SFr SFr 180-day interest rate (annualized) 4.01%-3.97% US $ 180-day interest rate (annualized) 8.01%-7.98% a) What is the hedged value of American's ticket sales using Forwards? b) What is the hedged value of American's ticket sales using Money Market? c) Choose the best (Forward or Money Market)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts