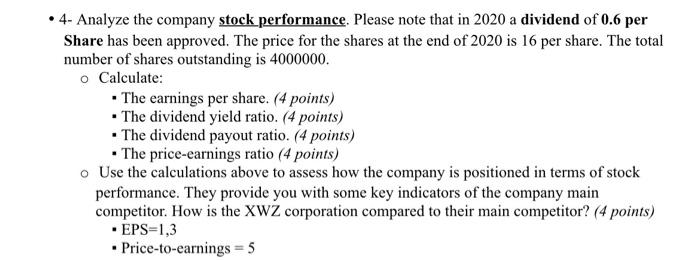

Question: - 4- Analyze the company stock performance. Please note that in 2020 a dividend of 0.6 per Share has been approved. The price for the

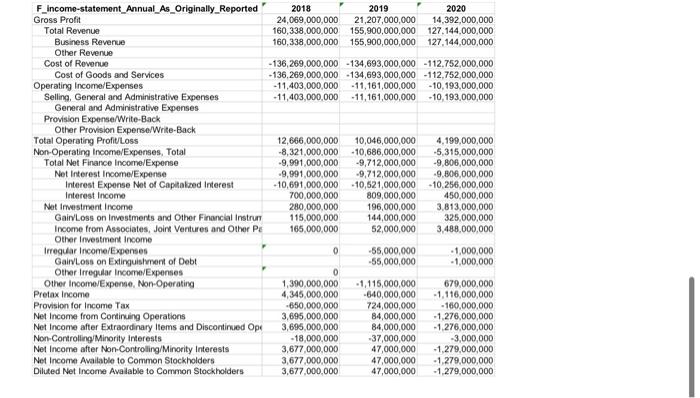

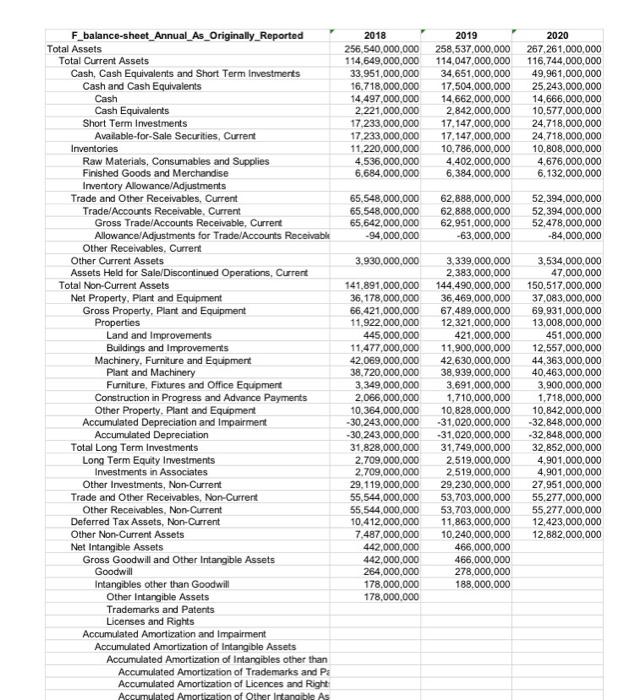

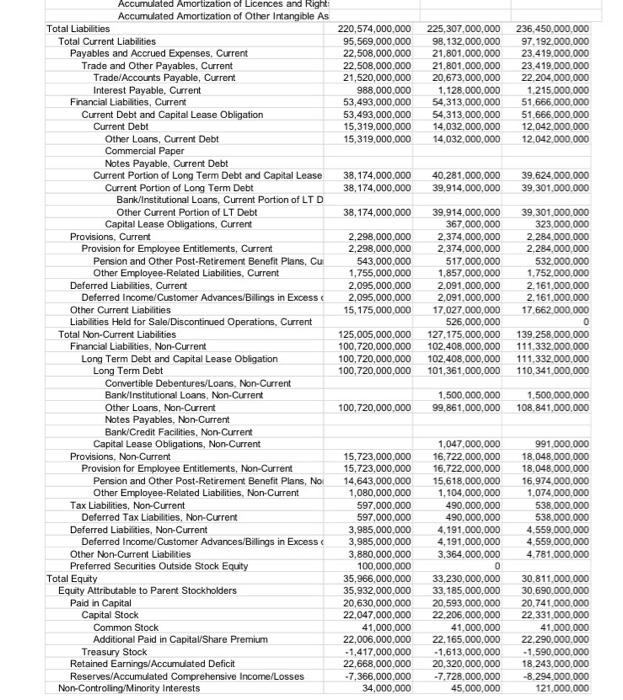

- 4- Analyze the company stock performance. Please note that in 2020 a dividend of 0.6 per Share has been approved. The price for the shares at the end of 2020 is 16 per share. The total number of shares outstanding is 4000000 . Calculate: - The earnings per share. (4 points) - The dividend yield ratio. (4 points) - The dividend payout ratio. (4 points) - The price-earnings ratio (4 points) Use the calculations above to assess how the company is positioned in terms of stock performance. They provide you with some key indicators of the company main competitor. How is the XWZ corporation compared to their main competitor? (4 points) - EPS=1,3 - Price-to-earnings =5 Accumulated Amortization of Licences and Right: Accumulated Amortization of Other Intangible As - 4- Analyze the company stock performance. Please note that in 2020 a dividend of 0.6 per Share has been approved. The price for the shares at the end of 2020 is 16 per share. The total number of shares outstanding is 4000000 . Calculate: - The earnings per share. (4 points) - The dividend yield ratio. (4 points) - The dividend payout ratio. (4 points) - The price-earnings ratio (4 points) Use the calculations above to assess how the company is positioned in terms of stock performance. They provide you with some key indicators of the company main competitor. How is the XWZ corporation compared to their main competitor? (4 points) - EPS=1,3 - Price-to-earnings =5 Accumulated Amortization of Licences and Right: Accumulated Amortization of Other Intangible As

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts