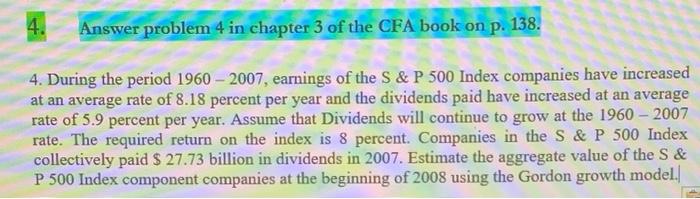

Question: 4. Answer problem 4 in chapter 3 of the CFA book on p. 138. 4. During the period 1960 - 2007, earnings of the S&P

4. Answer problem 4 in chapter 3 of the CFA book on p. 138. 4. During the period 1960 - 2007, earnings of the S&P 500 Index companies have increased at an average rate of 8.18 percent per year and the dividends paid have increased at an average rate of 5.9 percent per year. Assume that Dividends will continue to grow at the 1960 - 2007 rate. The required return on the index is 8 percent. Companies in the S&P 500 Index collectively paid $ 27.73 billion in dividends in 2007. Estimate the aggregate value of the S& P 500 Index component companies at the beginning of 2008 using the Gordon growth model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts