Question: 4. Assume that tFT2= FT1 (1 + TIFT2 ) + TICT2. Also assume that T2 - T is one year, T1CT2 = $1 and

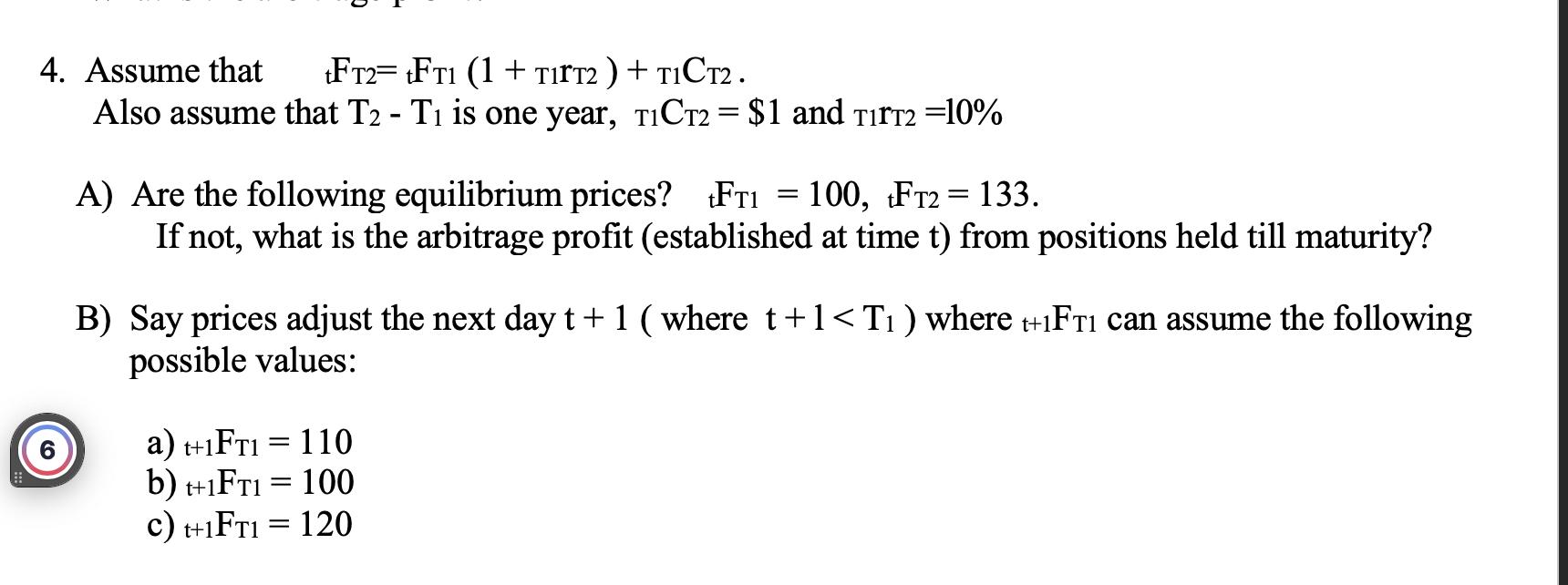

4. Assume that tFT2= FT1 (1 + TIFT2 ) + TICT2. Also assume that T2 - T is one year, T1CT2 = $1 and TITT2 =10% A) Are the following equilibrium prices? FT1 = 100, FT2= 133. If not, what is the arbitrage profit (established at time t) from positions held till maturity? B) Say prices adjust the next day t + 1 (where t+1 < T ) where t+1FT can assume the following possible values: a) t+1FT1 = 110 b) t+1FT1 = 100 c) t+1FT1 = 120

Step by Step Solution

3.33 Rating (138 Votes )

There are 3 Steps involved in it

A No the equilibrium prices are not t FT 1 100 and t FT 2 133 The arbit rage p... View full answer

Get step-by-step solutions from verified subject matter experts