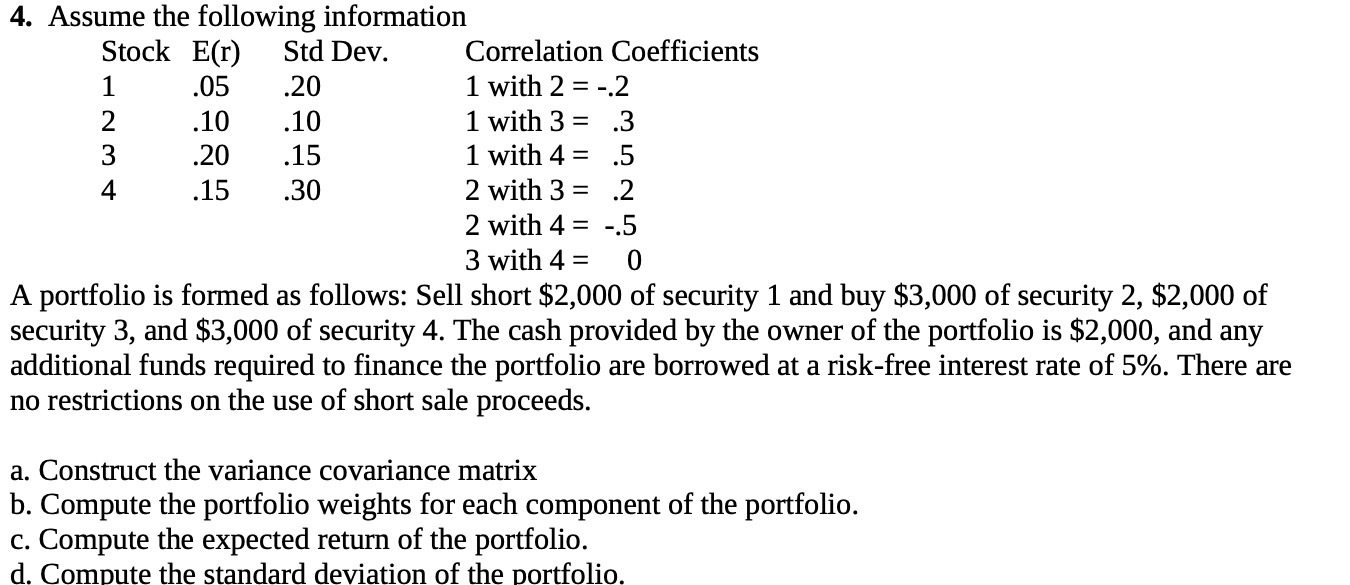

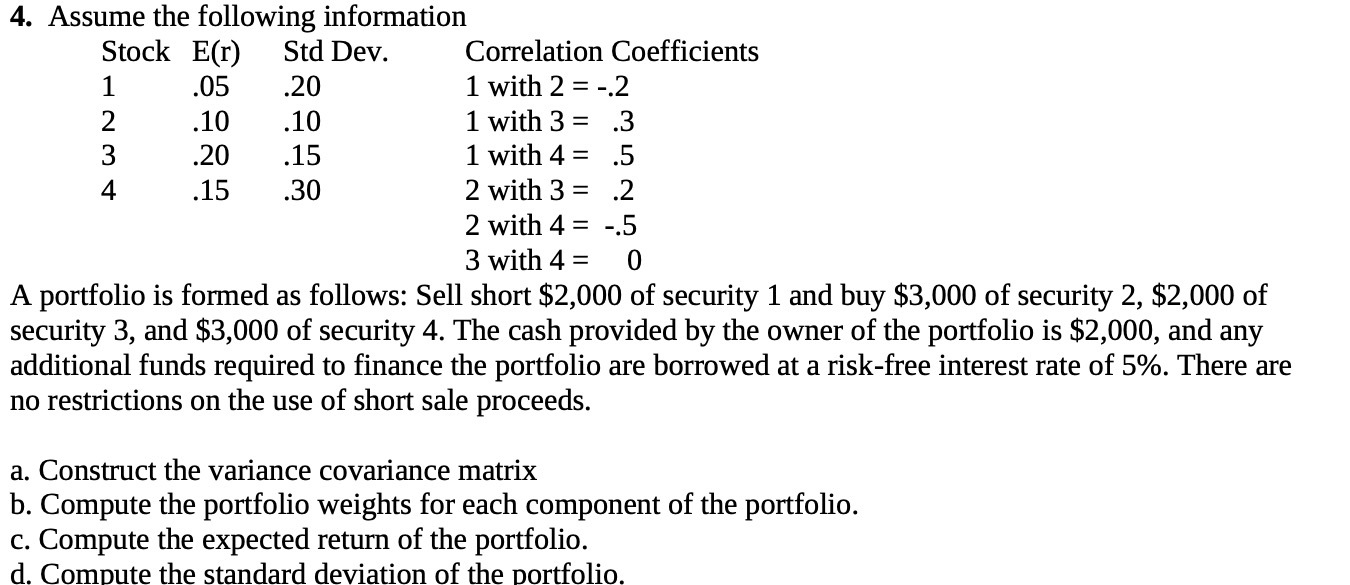

Question: 4. Assume the following information Stock E(r) Std Dev. Correlation Coefficients 1 .05 .20 1 with 2 = -.2 2 .10 .10 1with3= .3 3

4. Assume the following information Stock E(r) Std Dev. Correlation Coefficients 1 .05 .20 1 with 2 = -.2 2 .10 .10 1with3= .3 3 .20 .15 1 with 4 = .5 4 .15 .30 2 with 3 = .2 2 with 4 = -.5 3 with 4 = 0 A portfolio is formed as follows: Sell short $2,000 of security 1 and buy $3,000 of security 2, $2,000 of security 3, and $3,000 of security 4. The cash provided by the owner of the portfolio is $2,000, and any additional funds required to finance the portfolio are borrowed at a risk-free interest rate of 5%. There are no restrictions on the use of short sale proceeds. a. Construct the variance covariance matrix b. Compute the portfolio weights for each component of the portfolio. c. Compute the expected return of the portfolio. d. Compute the standard deviation of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts