Question: 4. ATCF Replacement Analysis. Machine A was purchased three years ago for $16,000 and had an estimated market value of $4,000 at the end of

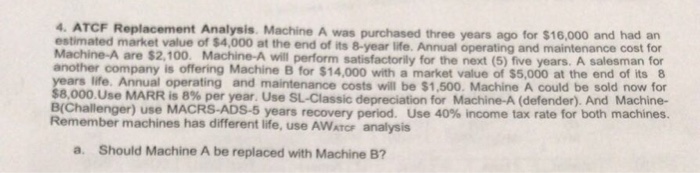

4. ATCF Replacement Analysis. Machine A was purchased three years ago for $16,000 and had an estimated market value of $4,000 at the end of its 8-year life. Annual operating and maintenance cost for Machine-A are $2,100, Machine-A will perform satisfactorily for the next (5) five years. A salesman for another company is offering Machine B for $14,000 with a market value of $5,000 at the end of its 8 ars life. Annual operating and maintenance costs will be $1,500. Machine A could be sold now for 8,000 Use MARR is 8% per year. Use SL-Classic depreciation for Machine-A (defender). And Machine. enger) use MACRS-ADS-5 years recovery period. Use 40% income tax rate for both machines. yea B(Chall Remember machines has different life, use AWAToP analysis a. Should Machine A be replaced with Machine B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts