Question: 4 B. (20 Marks) 1. How does Depreciation impact on the company's tax? What is a Half Yearly Rule? Please explain your answer in a

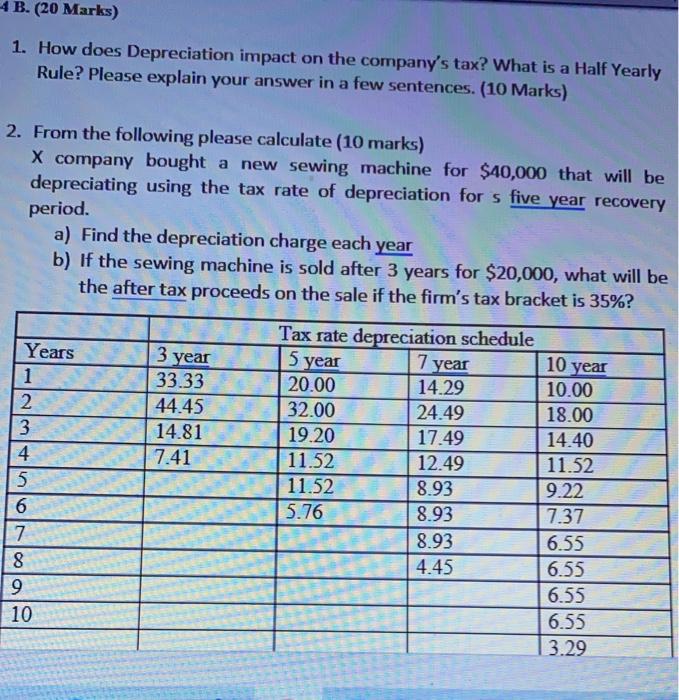

4 B. (20 Marks) 1. How does Depreciation impact on the company's tax? What is a Half Yearly Rule? Please explain your answer in a few sentences. (10 Marks) 2. From the following please calculate (10 marks) X company bought a new sewing machine for $40,000 that will be depreciating using the tax rate of depreciation for s five year recovery period. a) Find the depreciation charge each year b) If the sewing machine is sold after 3 years for $20,000, what will be the after tax proceeds on the sale if the firm's tax bracket is 35%? Tax rate depreciation schedule 3 year 5 year 7 year 10 year 10.00 Years 1 2 3 4 5 33.33 44.45 14.81 7.41 20.00 32.00 19.20 11.52 11.52 14.29 24.49 17.49 12.49 8.93 8.93 8.93 4.45 5.76 7 8 9 10 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.55 6.55 3.29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts