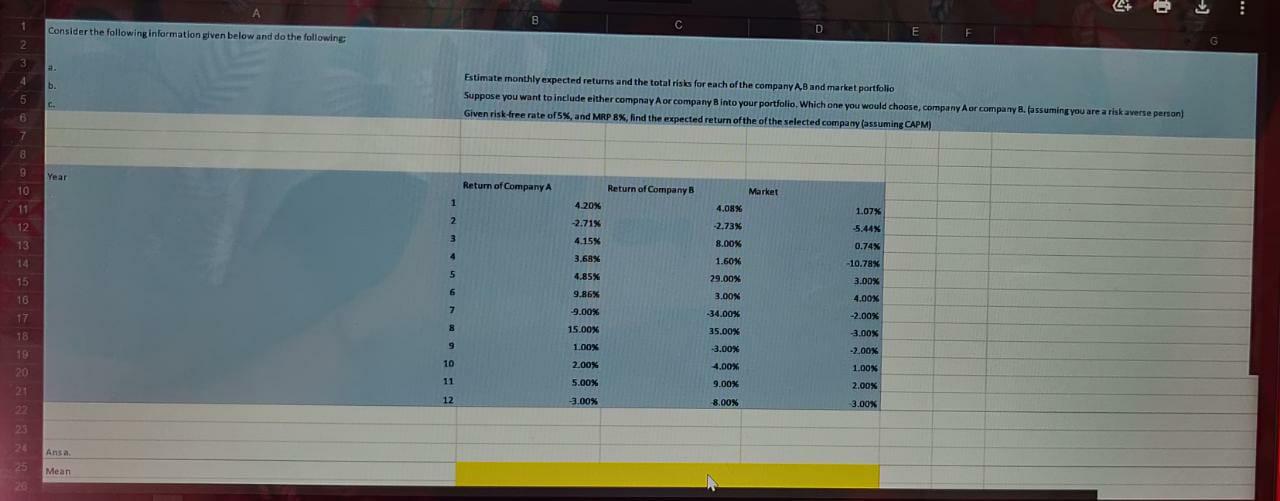

Question: 4+ B Consider the following information given below and do the following D E 2 G 3 # b. 5 Estimate monthly expected returns and

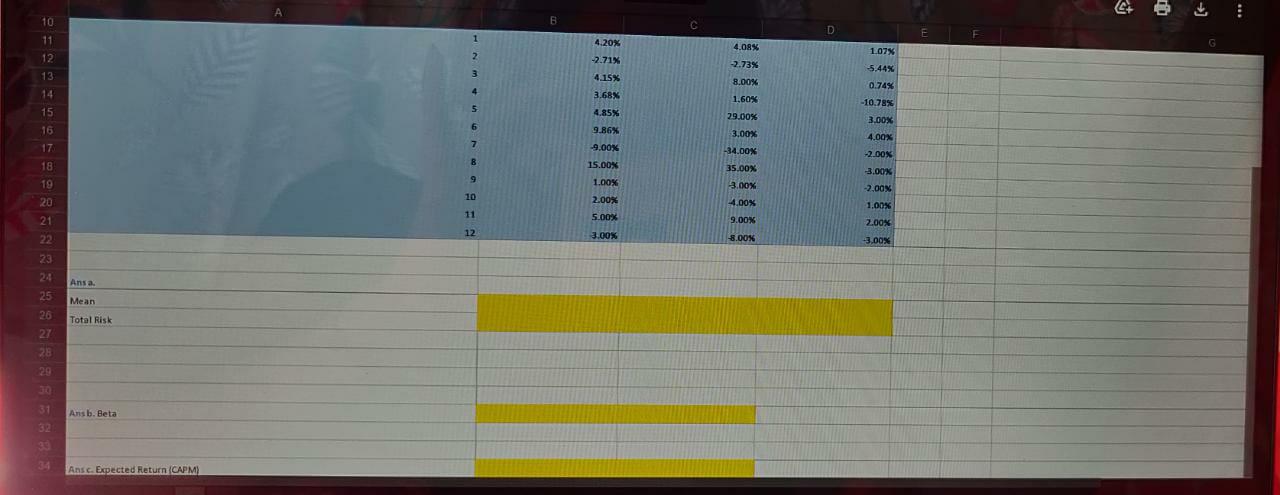

4+ B Consider the following information given below and do the following D E 2 G 3 # b. 5 Estimate monthly expected returns and the total risks for each of the company A, B and market portfolio Suppose you want to include either compnay A or company into your portfolio. Which one you would choose, company or company, assuming you are a risk averse person) Given risk-free rate of 5%, and MRP BX, find the expected return of the of the selected company (assuming CAPM) B 7 8 9 Year 10 Return of Company A Return of Company B Market 1 4.20% 4.08 1.07% 11 12 13 14 2 2 3 -2.73% -2.71% 4.15% -5.44% 0.74% 8.00% 4 3.68% -10.78% 5 15 10 4.85% 9.86% 6 1.60% 29.00% 3.00% -34.00% 35.00% 3.00% 4.00% 7 7 9.00% -2.00% 17 18 8 15.00% 9 100% 3.00% 10 2.00% 3.00% -2.00% 1.00% 2.00% 19 20 21 4.00% 11 5.00% 9.00% 8.00 12 3.00% 3.00% 22 23 25 Mean 10 B B C D E 1 4,08% G 2 4.20% -2.71% -2.73% 1.07% 5.44% 3 4.15% 8.00% 0.74% 4 1.60% 11 12 13 14 15 16 17 18 3.68% 4.85% -10.7898 5 29.00% 3.00% 6 6 9.86% 4.00% 3.00% -34.00 7 8 -9.00 -2.00% 15.OON -3.00% 9 35.00% 3.00% 19 1.00% -2.00% 10 4.00% 20 21 2.00% 5.00% 1.00% 11 9.00% 12 3.00% 2.00% 3.00% -8.00 22 23 24 25 Ansa Mean Total Risk 26 27 28 29 30 Ansb. Beta 31 32 30 Ansc. Expected Return (CAPM)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts