Question: 4) Based on the answer from part (3), discuss the KLCI and the SUNREIT stocks' riskiness in terms of beta and standard deviation, in relation

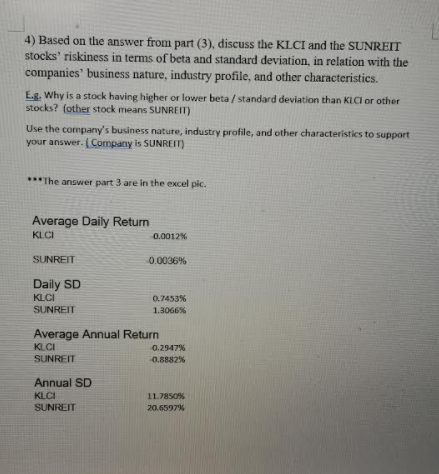

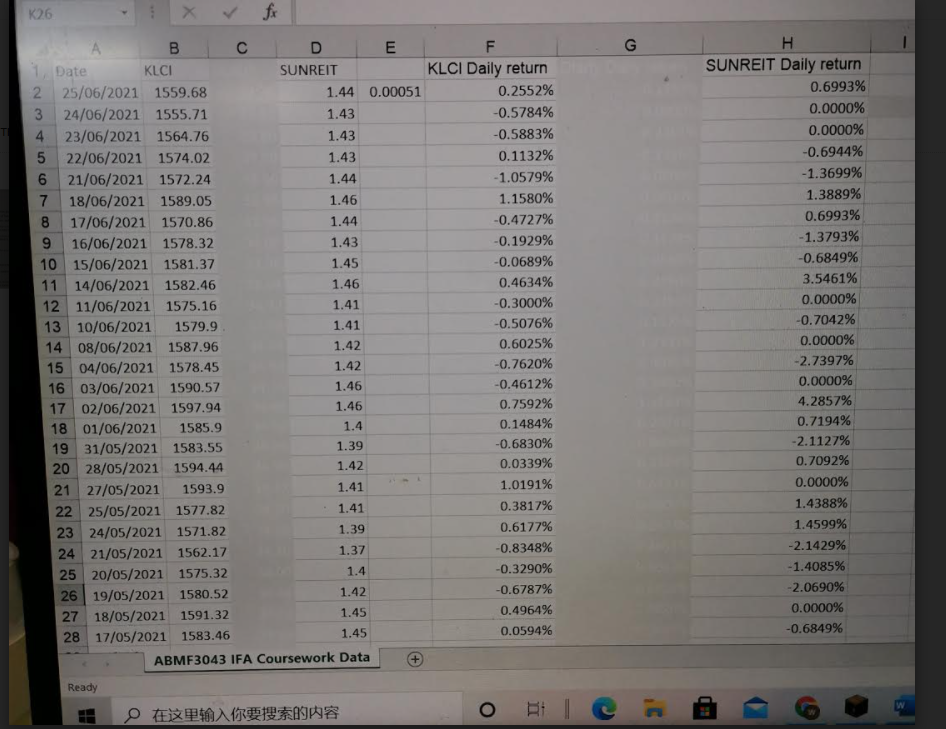

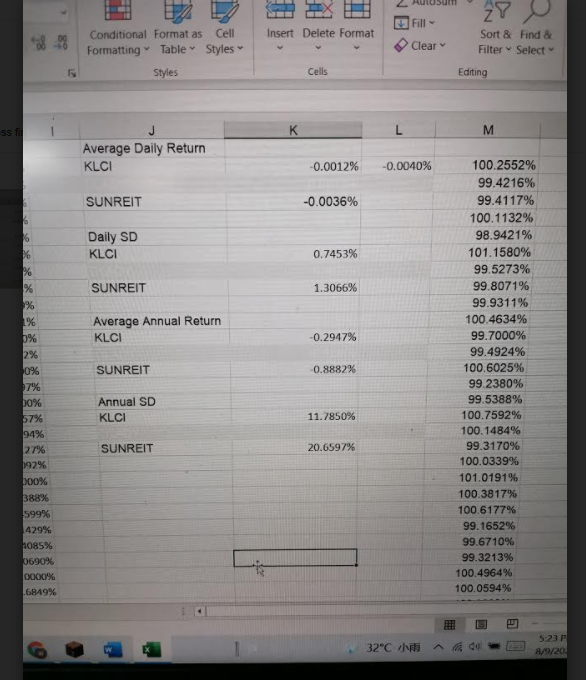

4) Based on the answer from part (3), discuss the KLCI and the SUNREIT stocks' riskiness in terms of beta and standard deviation, in relation with the companies' business nature, industry profile, and other characteristics. E.g. Why is a stock having higher or lower beta/ standard deviation than KLC or other stocks? (other stock means SUNREIT) Use the company's business nature, industry profile, and other characteristies to support your answer. Company is SUNREIT) ***The answer part 3 are in the excel pic. Average Daily Return KLCI 0.0012% SUNREIT 0.0036% Daily SD KLCI SUNREIT 0.7453% 1.3066% Average Annual Return KLCI 0.2947% SUNREIT 0.8882% Annual SD KLCI SUNREIT 11.78509 20.6597"% K26 fr G B E 1 Date KLCI SUNREIT 2 25/06/2021 1559.68 1.44 0.00051 3 24/06/2021 1555.71 1.43 23/06/2021 1564.76 1.43 5 22/06/2021 1574.02 1.43 6 21/06/2021 1572.24 1.44 7 18/06/2021 1589.05 1.46 8 17/06/2021 1570.86 1.44 9 16/06/2021 1578.32 1.43 10 15/06/2021 1581.37 1.45 11 14/06/2021 1582.46 1.46 12 11/06/2021 1575.16 1.41 13 10/06/2021 1579.9 1.41 14 08/06/2021 1587.96 1.42 15 04/06/2021 1578.45 1.42 16 03/06/2021 1590.57 1.46 17 02/06/2021 1597.94 1.46 18 01/06/2021 1585.9 1.4 19 31/05/2021 1583.55 1.39 20 28/05/2021 1594.44 1.42 21 27/05/2021 1593.9 1.41 22 25/05/2021 1577.82 1.41 23 24/05/2021 1571.82 1.39 24 21/05/2021 1562.17 1.37 25 20/05/2021 1575.32 1.4 26 19/05/2021 1580.52 1.42 27 18/05/2021 1591.32 1.45 28 17/05/2021 1583.46 1.45 ABMF3043 IFA Coursework Data F KLCI Daily return 0.2552% -0.5784% -0.5883% 0.1132% -1.0579% 1.1580% -0.4727% -0.1929% -0.0689% 0.4634% -0.3000% -0.5076% 0.6025% -0.7620% -0.4612% 0.7592% 0.1484% -0.6830% 0.0339% 1.0191% 0.3817% 0.6177% -0.8348% -0.3290% -0.6787% 0.4964% 0.0594% H SUNREIT Daily return 0.6993% 0.0000% 0.0000% -0.6944% -1.3699% 1.3889% 0.6993% -1.3793% -0.6849% 3.5461% 0.0000% -0.7042% 0.0000% -2.7397% 0.0000% 4.2857% 0.7194% -2.1127% 0.7092% 0.0000% 1.4388% 1.4599% -2.1429% -1.4085% -2.0690% 0.0000% -0.6849% Ready O 2 AU 29 Fill Insert Delete Format Clear Conditional Format as Cell Formatting Table Styles Styles Sort & Find & Filter Select Cells Editing SS M Average Daily Return KLCI -0.0012% -0.0040% SUNREIT -0.0036% 6 Daily SD KLCI 0.7453% SUNREIT 1.3066% % % % % 0% Average Annual Return KLCI -0.2947% 2% SUNREIT 0.8882% 100.2552% 99.4216% 99.4117% 100.1132% 98.9421% 101.1580% 99.5273% 99.8071% 99.9311% 100.4634% 99.7000% 99.4924% 100.6025% 99.2380% 99.5388% 100.7592% 100.1484% 99.3170% 100.0339% 101.0191% 100.3817% 100.6177% 99.1652% 99.6710% 99.321396 100.4964% 100.0594% Annual SD KLCI 11.7850% SUNREIT 0% 67% po% 57% 94% 27% 197% 100% 38896 599% 429% 1085% 0690% 0000% 6849% 20.6597% is 32C 5:23 PM A/V20 4) Based on the answer from part (3), discuss the KLCI and the SUNREIT stocks' riskiness in terms of beta and standard deviation, in relation with the companies' business nature, industry profile, and other characteristics. E.g. Why is a stock having higher or lower beta/ standard deviation than KLC or other stocks? (other stock means SUNREIT) Use the company's business nature, industry profile, and other characteristies to support your answer. Company is SUNREIT) ***The answer part 3 are in the excel pic. Average Daily Return KLCI 0.0012% SUNREIT 0.0036% Daily SD KLCI SUNREIT 0.7453% 1.3066% Average Annual Return KLCI 0.2947% SUNREIT 0.8882% Annual SD KLCI SUNREIT 11.78509 20.6597"% K26 fr G B E 1 Date KLCI SUNREIT 2 25/06/2021 1559.68 1.44 0.00051 3 24/06/2021 1555.71 1.43 23/06/2021 1564.76 1.43 5 22/06/2021 1574.02 1.43 6 21/06/2021 1572.24 1.44 7 18/06/2021 1589.05 1.46 8 17/06/2021 1570.86 1.44 9 16/06/2021 1578.32 1.43 10 15/06/2021 1581.37 1.45 11 14/06/2021 1582.46 1.46 12 11/06/2021 1575.16 1.41 13 10/06/2021 1579.9 1.41 14 08/06/2021 1587.96 1.42 15 04/06/2021 1578.45 1.42 16 03/06/2021 1590.57 1.46 17 02/06/2021 1597.94 1.46 18 01/06/2021 1585.9 1.4 19 31/05/2021 1583.55 1.39 20 28/05/2021 1594.44 1.42 21 27/05/2021 1593.9 1.41 22 25/05/2021 1577.82 1.41 23 24/05/2021 1571.82 1.39 24 21/05/2021 1562.17 1.37 25 20/05/2021 1575.32 1.4 26 19/05/2021 1580.52 1.42 27 18/05/2021 1591.32 1.45 28 17/05/2021 1583.46 1.45 ABMF3043 IFA Coursework Data F KLCI Daily return 0.2552% -0.5784% -0.5883% 0.1132% -1.0579% 1.1580% -0.4727% -0.1929% -0.0689% 0.4634% -0.3000% -0.5076% 0.6025% -0.7620% -0.4612% 0.7592% 0.1484% -0.6830% 0.0339% 1.0191% 0.3817% 0.6177% -0.8348% -0.3290% -0.6787% 0.4964% 0.0594% H SUNREIT Daily return 0.6993% 0.0000% 0.0000% -0.6944% -1.3699% 1.3889% 0.6993% -1.3793% -0.6849% 3.5461% 0.0000% -0.7042% 0.0000% -2.7397% 0.0000% 4.2857% 0.7194% -2.1127% 0.7092% 0.0000% 1.4388% 1.4599% -2.1429% -1.4085% -2.0690% 0.0000% -0.6849% Ready O 2 AU 29 Fill Insert Delete Format Clear Conditional Format as Cell Formatting Table Styles Styles Sort & Find & Filter Select Cells Editing SS M Average Daily Return KLCI -0.0012% -0.0040% SUNREIT -0.0036% 6 Daily SD KLCI 0.7453% SUNREIT 1.3066% % % % % 0% Average Annual Return KLCI -0.2947% 2% SUNREIT 0.8882% 100.2552% 99.4216% 99.4117% 100.1132% 98.9421% 101.1580% 99.5273% 99.8071% 99.9311% 100.4634% 99.7000% 99.4924% 100.6025% 99.2380% 99.5388% 100.7592% 100.1484% 99.3170% 100.0339% 101.0191% 100.3817% 100.6177% 99.1652% 99.6710% 99.321396 100.4964% 100.0594% Annual SD KLCI 11.7850% SUNREIT 0% 67% po% 57% 94% 27% 197% 100% 38896 599% 429% 1085% 0690% 0000% 6849% 20.6597% is 32C 5:23 PM A/V20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts