Question: 4. Based on the following selected data, journalize the adjusting entries as of December 31, 2016 on page 23 of the journal: Estimated uncollectible accounts

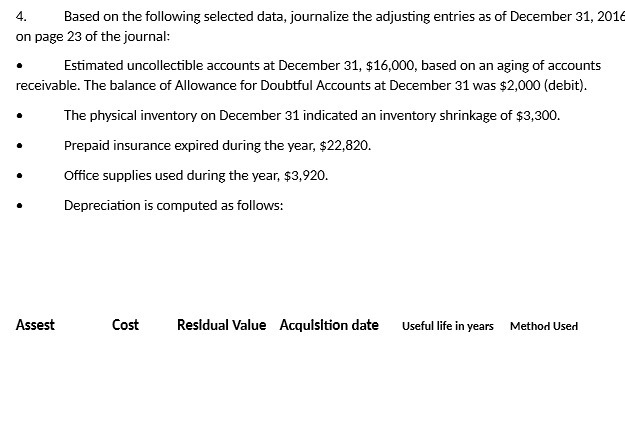

4. Based on the following selected data, journalize the adjusting entries as of December 31, 2016 on page 23 of the journal: Estimated uncollectible accounts at December 31, $16,000, based on an aging of accounts receivable. The balance of Allowance for Doubtful Accounts at December 31 was $2,000 (debit). The physical inventory on December 31 indicated an inventory shrinkage of $3,300. Prepaid insurance expired during the year, $22,820. Office supplies used during the year, $3,920. Depreciation is computed as follows: Assest Cost Residual Value Acquisition date Useful life in years Method Used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts