Question: 4. Becker Industries is considering an all equity capital structure against one with both debt and equity. The all equity capital structure would consist of

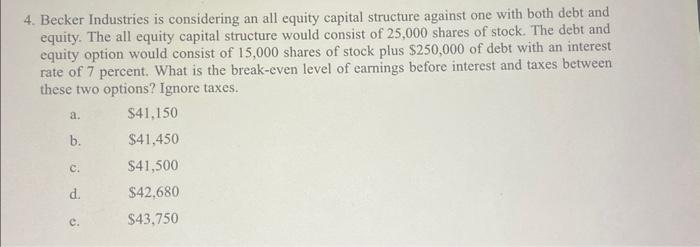

4. Becker Industries is considering an all equity capital structure against one with both debt and equity. The all equity capital structure would consist of 25,000 shares of stock. The debt and equity option would consist of 15,000 shares of stock plus $250,000 of debt with an interest rate of 7 percent. What is the break-even level of earnings before interest and taxes between these two options? Ignore taxes. a. $41,150 b. $41,450 c. $41,500 d. $42,680 c. $43,750

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock