Question: 4. Bed Bath Beyond recently has announced that it won't be able to pay its interest and indicated that it might file for bankruptcy. What

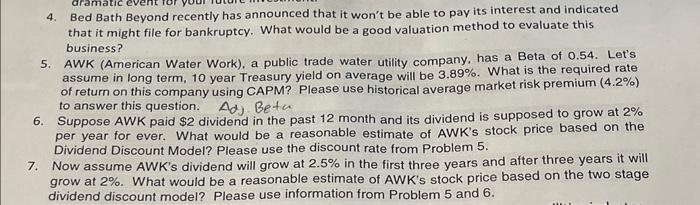

4. Bed Bath Beyond recently has announced that it won't be able to pay its interest and indicated that it might file for bankruptcy. What would be a good valuation method to evaluate this business? 5. AWK (American Water Work), a public trade water utility company, has a Beta of 0.54. Let's assume in long term, 10 year Treasury yield on average will be 3.89%. What is the required rate of return on this company using CAPM? Please use historical average market risk premium ( 4.2%) to answer this question. Adj. Beta. 6. Suppose AWK paid $2 dividend in the past 12 month and its dividend is supposed to grow at 2% per year for ever. What would be a reasonable estimate of AWK's stock price based on the Dividend Discount Model? Please use the discount rate from Problem 5. 7. Now assume AWK's dividend will grow at 2.5% in the first three years and after three years it will grow at 2%. What would be a reasonable estimate of AWK's stock price based on the two stage dividend discount model? Please use information from Problem 5 and 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts