Question: 4. Calculation (45 points, requirement: You should give the process.) (1) Tobi owns a perpetuity that will pay $1,500 a year, starting one year from

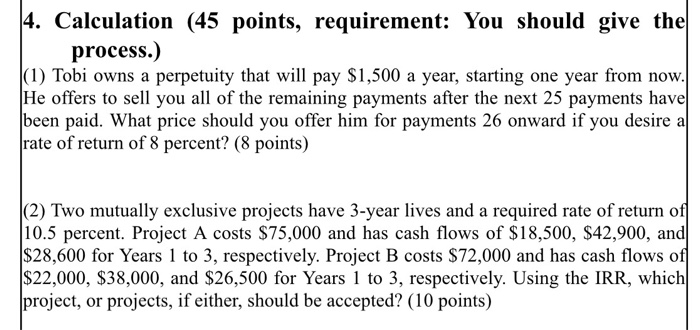

4. Calculation (45 points, requirement: You should give the process.) (1) Tobi owns a perpetuity that will pay $1,500 a year, starting one year from now. He offers to sell you all of the remaining payments after the next 25 payments have been paid. What price should you offer him for payments 26 onward if you desire a rate of return of 8 percent? (8 points) (2) Two mutually exclusive projects have 3-year lives and a required rate of return of 10.5 percent. Project A costs $75,000 and has cash flows of $18,500, $42,900, and $28,600 for Years 1 to 3, respectively. Project B costs $72,000 and has cash flows of $22,000, $38,000, and $26,500 for Years 1 to 3, respectively. Using the IRR, which project, or projects, if either, should be accepted? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts