Question: 4. Certain items deducted in computing a corporation's current year taxable income are added back to compute earnings and profits because: A.___They represent deductions

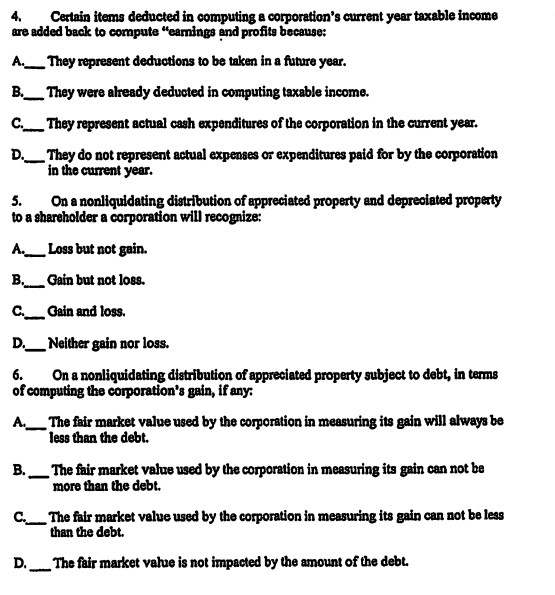

4. Certain items deducted in computing a corporation's current year taxable income are added back to compute "earnings and profits because: A.___They represent deductions to be taken in a future year. B.__ They were already deducted in computing taxable income. C. They represent actual cash expenditures of the corporation in the current year. D. They do not represent actual expenses or expenditures paid for by the corporation in the current year. 5. On a nonliquidating distribution of appreciated property and depreciated property to a shareholder a corporation will recognize: A.___Loss but not gain. B. Gain but not loss. C. Gain and loss. D.____Neither gain nor loss. 6. On a nonliquidating distribution of appreciated property subject to debt, in terms of computing the corporation's gain, if any: B.____The fair market value used by the corporation in measuring its gain can not be more than the debt. D. The fair market value used by the corporation in measuring its gain will always be less than the debt. - The fair market value used by the corporation in measuring its gain can not be less than the debt. The fair market value is not impacted by the amount of the debt. 4. Certain items deducted in computing a corporation's current year taxable income are added back to compute "earnings and profits because: A._____They represent deductions to be taken in a future year. B.___ They were already deducted in computing taxable income. C._____ They represent actual cash expenditures of the corporation in the current year. D. They do not represent actual expenses or expenditures paid for by the corporation in the current year. 5. On a nonliquidating distribution of appreciated property and depreciated property to a shareholder a corporation will recognize: A.___Loss but not gain. B. Gain but not loss. C. Gain and loss. D.____ Neither gain nor loss. 6. On a nonliquidating distribution of appreciated property subject to debt, in terms of computing the corporation's gain, if any: B. ____The fair market value used by the corporation in measuring its gain can not be more than the debt. D. The fair market value used by the corporation in measuring its gain will always be less than the debt. - The fair market value used by the corporation in measuring its gain can not be less than the debt. The fair market value is not impacted by the amount of the debt. 4. Certain items deducted in computing a corporation's current year taxable income are added back to compute "earnings and profits because: A.___They represent deductions to be taken in a future year. B.___ They were already deducted in computing taxable income. C. They represent actual cash expenditures of the corporation in the current year. D. They do not represent actual expenses or expenditures paid for by the corporation in the current year. 5. On a nonliquidating distribution of appreciated property and depreciated property to a shareholder a corporation will recognize: A.___Loss but not gain. B. Gain but not loss. C. Gain and loss. D.__ Neither gain nor loss. 6. On a nonliquidating distribution of appreciated property subject to debt, in terms of computing the corporation's gain, if any: B._____The fair market value used by the corporation in measuring its gain can not be more than the debt. D. The fair market value used by the corporation in measuring its gain will always be less than the debt. - The fair market value used by the corporation in measuring its gain can not be less than the debt. The fair market value is not impacted by the amount of the debt. 4. Certain items deducted in computing a corporation's current year taxable income are added back to compute "earnings and profits because: A._____ They represent deductions to be taken in a future year. B.___ They were already deducted in computing taxable income. C._____ They represent actual cash expenditures of the corporation in the current year. D. They do not represent actual expenses or expenditures paid for by the corporation in the current year. 5. On a nonliquidating distribution of appreciated property and depreciated property to a shareholder a corporation will recognize: A. Loss but not gain. B. Gain but not loss. C. Gain and loss. D.____Neither gain nor loss. 6. On a nonliquidating distribution of appreciated property subject to debt, in terms of computing the corporation's gain, if any: B.____ The fair market value used by the corporation in measuring its gain can not be more than the debt. D. The fair market value used by the corporation in measuring its gain will always be less than the debt. - The fair market value used by the corporation in measuring its gain can not be less than the debt. The fair market value is not impacted by the amount of the debt.

Step by Step Solution

There are 3 Steps involved in it

4 Certain items deducted in computing a corporations current year taxable income are added back to c... View full answer

Get step-by-step solutions from verified subject matter experts