Question: 4. Choose a stock that does not pay a dividend and that has traded options. Find a pair of options (put and call) with the

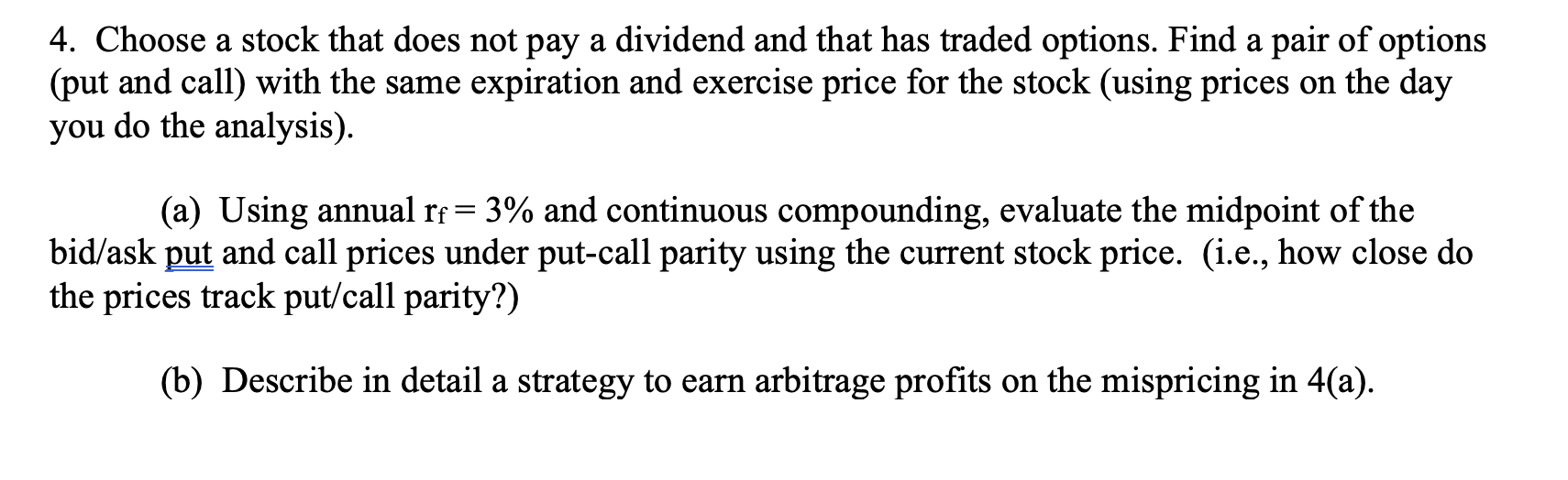

4. Choose a stock that does not pay a dividend and that has traded options. Find a pair of options (put and call) with the same expiration and exercise price for the stock (using prices on the day you do the analysis). (a) Using annual rf=3% and continuous compounding, evaluate the midpoint of the bid/ask put and call prices under put-call parity using the current stock price. (i.e., how close do the prices track put/call parity?) (b) Describe in detail a strategy to earn arbitrage profits on the mispricing in 4(a). 4. Choose a stock that does not pay a dividend and that has traded options. Find a pair of options (put and call) with the same expiration and exercise price for the stock (using prices on the day you do the analysis). (a) Using annual rf=3% and continuous compounding, evaluate the midpoint of the bid/ask put and call prices under put-call parity using the current stock price. (i.e., how close do the prices track put/call parity?) (b) Describe in detail a strategy to earn arbitrage profits on the mispricing in 4(a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts