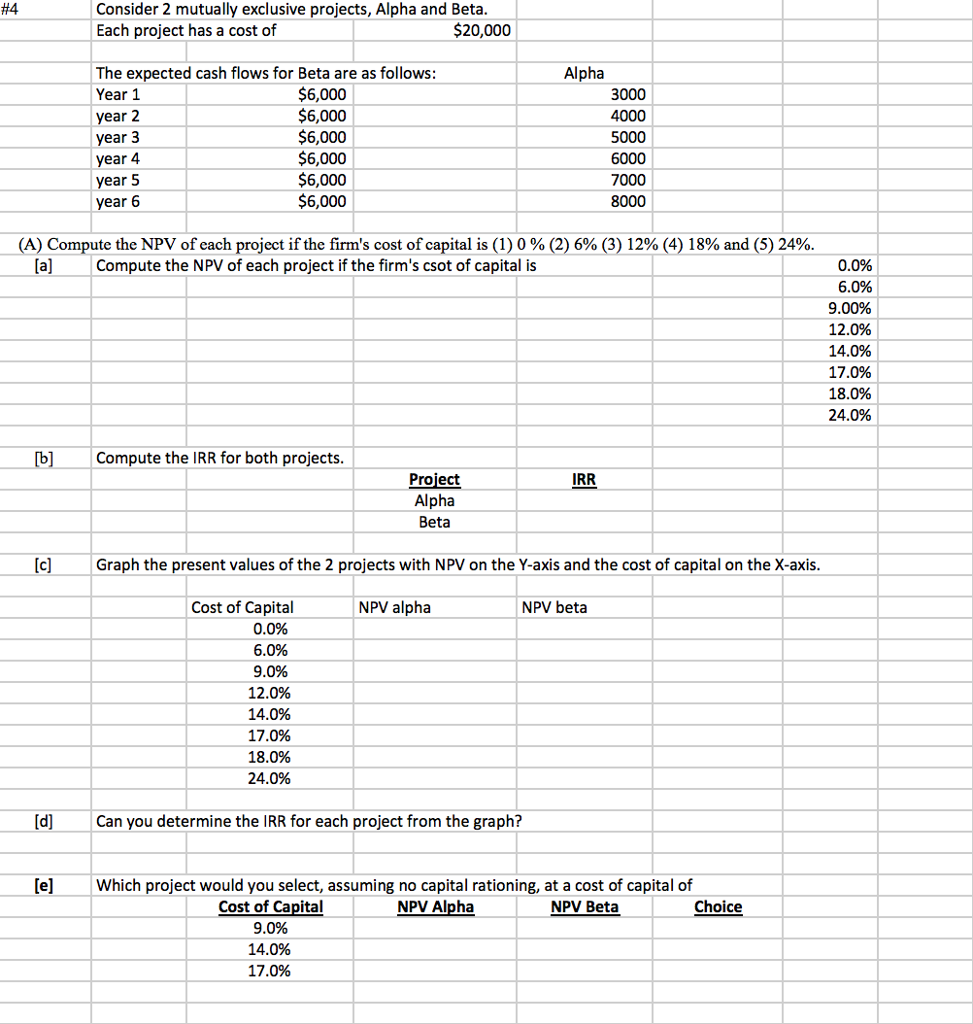

Question: #4 Consider 2 mutually exclusive projects, Alpha and Beta Each project has a cost of $20,000 Alpha The expected cash flows for Beta are as

#4 Consider 2 mutually exclusive projects, Alpha and Beta Each project has a cost of $20,000 Alpha The expected cash flows for Beta are as follows Year 1 ear 2 year 3 ear 4 year 5 year 6 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 3000 4000 5000 6000 7000 8000 (A) Compute the NPV of each project if the firm's cost of capital is (1) 0 % (2) 6% (3) 12% (4) 18% and (5) 24% [a]Compute the NPV of each project if the firm's csot of capital is 0.0% 6.0% 9.00% 12.0% 14.0% 17.0% 18.0% 24.0% Compute the IRR for both projects Project Alpha Beta IRR Graph the present values of the 2 projects with NPV on the Y-axis and the cost of capital on the X-axis Cost of Capital 0.0% 60% 9.0% 12.0% 14.0% 17.0% 18.0% 24.0% NPV alpha NPV beta [d] Can you determine the IRR for each project from the graph? [e]Which project would you select, assuming no capital rationing, at a cost of capital of Choice Cost of Capital 9.0% 14.0% 17.0% NPV Alpha NPV Beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts