Question: 4 Consider a Binary Call Option with a strike of 115. The option pays 1 at expiry if the price of the underlying asset at

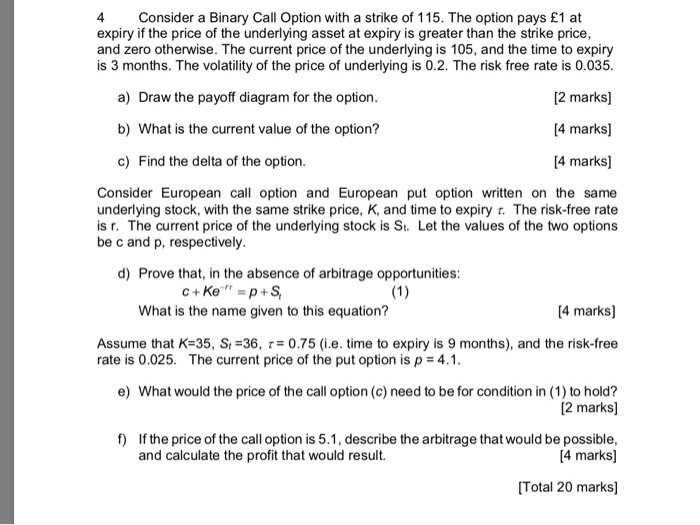

4 Consider a Binary Call Option with a strike of 115. The option pays 1 at expiry if the price of the underlying asset at expiry is greater than the strike price, and zero otherwise. The current price of the underlying is 105, and the time to expiry is 3 months. The volatility of the price of underlying is 0.2. The risk free rate is 0.035. a) Draw the payoff diagram for the option. [2 marks] b) What is the current value of the option? [4 marks] c) Find the delta of the option. [4 marks) Consider European call option and European put option written on the same underlying stock, with the same strike price, K, and time to expiry 7. The risk-free rate is r. The current price of the underlying stock is St. Let the values of the two options be c and p, respectively. d) Prove that in the absence of arbitrage opportunities: C+Ke" =p+S, (1) What is the name given to this equation? [4 marks) Assume that K=35, S =36, p= 0.75 (i.e. time to expiry is 9 months), and the risk-free rate is 0.025. The current price of the put option is p = 4.1. e) What would the price of the call option (c) need to be for condition in (1) to hold? [2 marks) f) If the price of the call option is 5.1, describe the arbitrage that would be possible, and calculate the profit that would result. [4 marks) [Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts