Question: 4. Consider a model with a unique risk-neutral measure P and constant interest rate T. According to the risk-neutral pricing formula, for 0 SIST, the

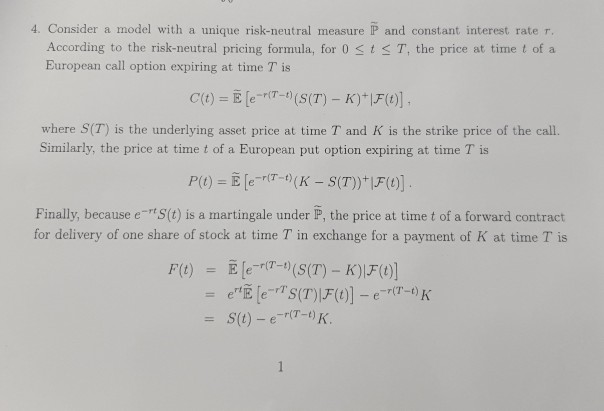

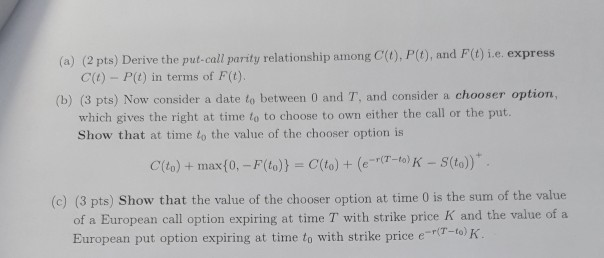

4. Consider a model with a unique risk-neutral measure P and constant interest rate T. According to the risk-neutral pricing formula, for 0 SIST, the price at time t of a European call option expiring at time T is C(t) = E [e- (T-)(S(T) - K) |F(t)). where S(T) is the underlying asset price at time T and K is the strike price of the call. Similarly, the price at time t of a European put option expiring at time T is P(t) = [e-r(T-1)(K - S(T))+F(0) Finally, because e""S() is a martingale under P, the price at time t of a forward contract for delivery of one share of stock at time T in exchange for a payment of K at time T is F(t) = [er(7-1(S(T) - K)F(0)] = e" [e-TS(T) F(t)] - e-( T K = S(t) ---T-K. (a) (2 pts) Derive the pul-call parity relationship among C(O), PO), and F(0) i.e. express C(1) - P(1) in terms of F(t). (b) (3 pts) Now consider a date to between 0 and T, and consider a chooser option, which gives the right at time to to choose to own either the call or the put. Show that at time to the value of the chooser option is C(to) + max{0,- F(to)} = C(to) + (e- (To) - S(to))* (C) (3 pts) Show that the value of the chooser option at time 0 is the sum of the value of a European call option expiring at time T with strike price K and the value of a European put option expiring at time to with strike price e-t-o) K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts