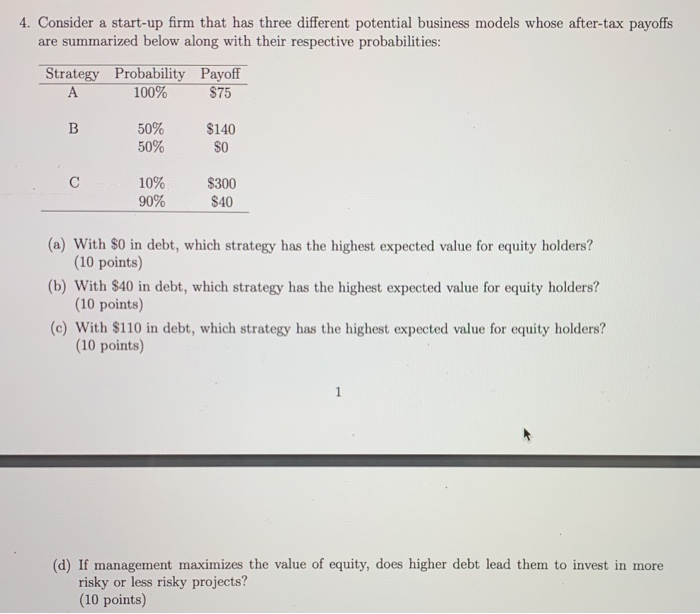

Question: 4. Consider a start-up firm that has three different potential business models whose after-tax payoffs are summarized below along with their respective probabilities: Strategy Probability

4. Consider a start-up firm that has three different potential business models whose after-tax payoffs are summarized below along with their respective probabilities: Strategy Probability Payoff A 100% $75 B 50% 50% $140 $0 c 10% 90% $300 $40 (a) With $0 in debt, which strategy has the highest expected value for equity holders? (10 points) (b) With $40 in debt, which strategy has the highest expected value for equity holders? (10 points) (c) With $110 in debt, which strategy has the highest expected value for equity holders? (10 points) 1 (d) If management maximizes the value of equity, does higher debt lead them to invest in more risky or less risky projects? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts