Question: 4. Consider a stock price process S(n), with n = 0,1,2, ..., that follows the Binomial Tree Model with S(0) = 50 and S(n+1) 1.1

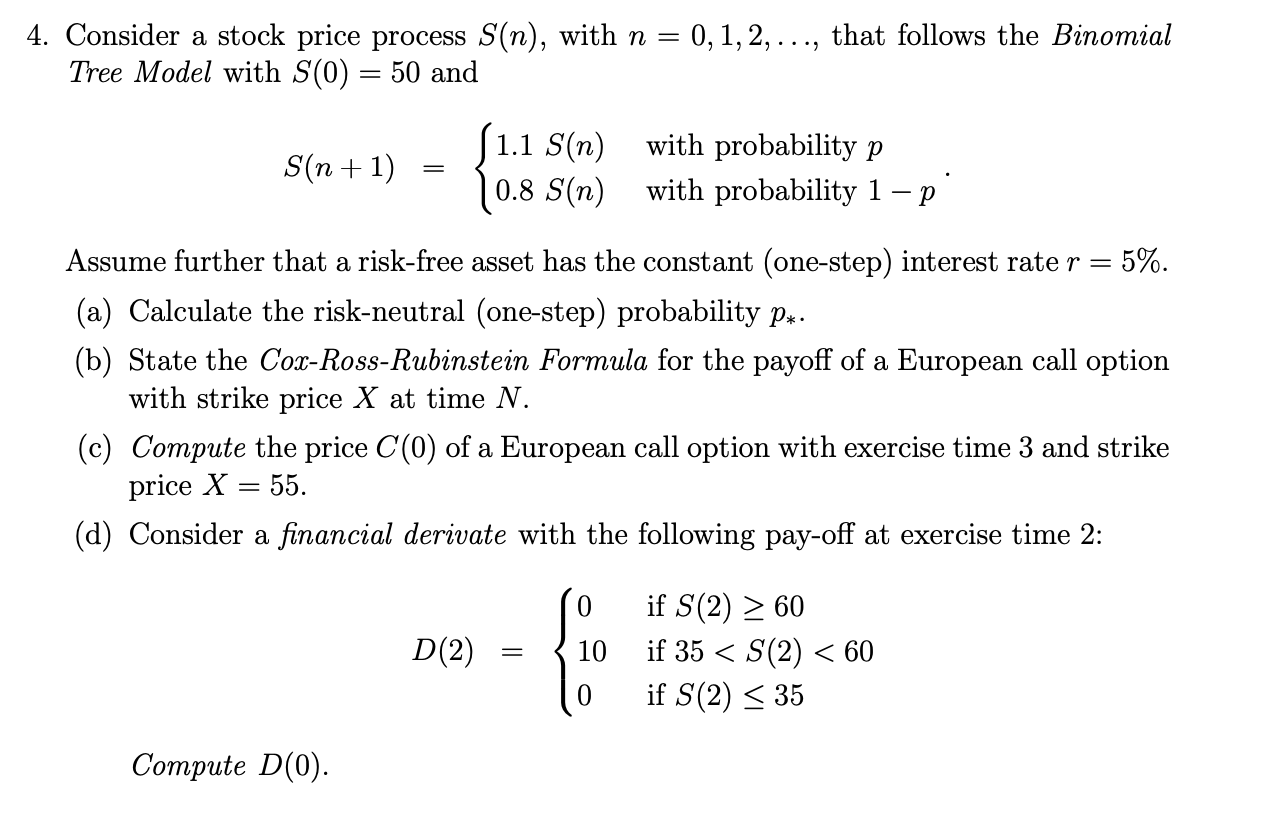

4. Consider a stock price process S(n), with n = 0,1,2, ..., that follows the Binomial Tree Model with S(0) = 50 and S(n+1) 1.1 S(n) with probability p 0.8 S(n) with probability 1 - p' - a Assume further that a risk-free asset has the constant (one-step) interest rate r = = 5%. (a) Calculate the risk-neutral (one-step) probability P*. (b) State the Cox-Ross-Rubinstein Formula for the payoff of a European call option with strike price X at time N. (c) Compute the price C(0) of a European call option with exercise time 3 and strike price X = 55. (d) Consider a financial derivate with the following pay-off at exercise time 2: 0 D(2) = 10 if S(2) > 60 if 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts