Question: 4 . Consider the consumption - savings problem for a two period asset choice problem. The preferences of the consumer are ( u

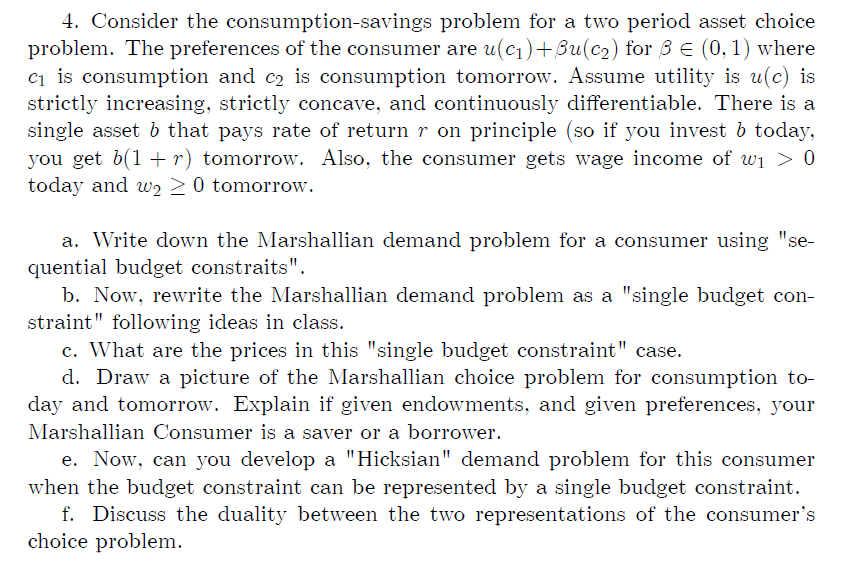

Consider the consumptionsavings problem for a two period asset choice problem. The preferences of the consumer are uleftcrightbeta uleftcright for beta in where c is consumption and c is consumption tomorrow. Assume utility is uc is strictly increasing, strictly concave, and continuously differentiable. There is a single asset b that pays rate of return r on principle so if you invest b today, you get br tomorrow. Also, the consumer gets wage income of w today and wgeq tomorrow.

a Write down the Marshallian demand problem for a consumer using "sequential budget constraits".

b Now, rewrite the Marshallian demand problem as a "single budget constraint" following ideas in class.

c What are the prices in this "single budget constraint" case.

d Draw a picture of the Marshallian choice problem for consumption today and tomorrow. Explain if given endowments, and given preferences, your Marshallian Consumer is a saver or a borrower.

e Now, can you develop a "Hicksian" demand problem for this consumer when the budget constraint can be represented by a single budget constraint.

f Discuss the duality between the two representations of the consumer's choice problem.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock