Question: 4. Consider the linear program in Problem 3. The value of the optimal solution is 48. Sup- pose that the right-hand side for constraint 1

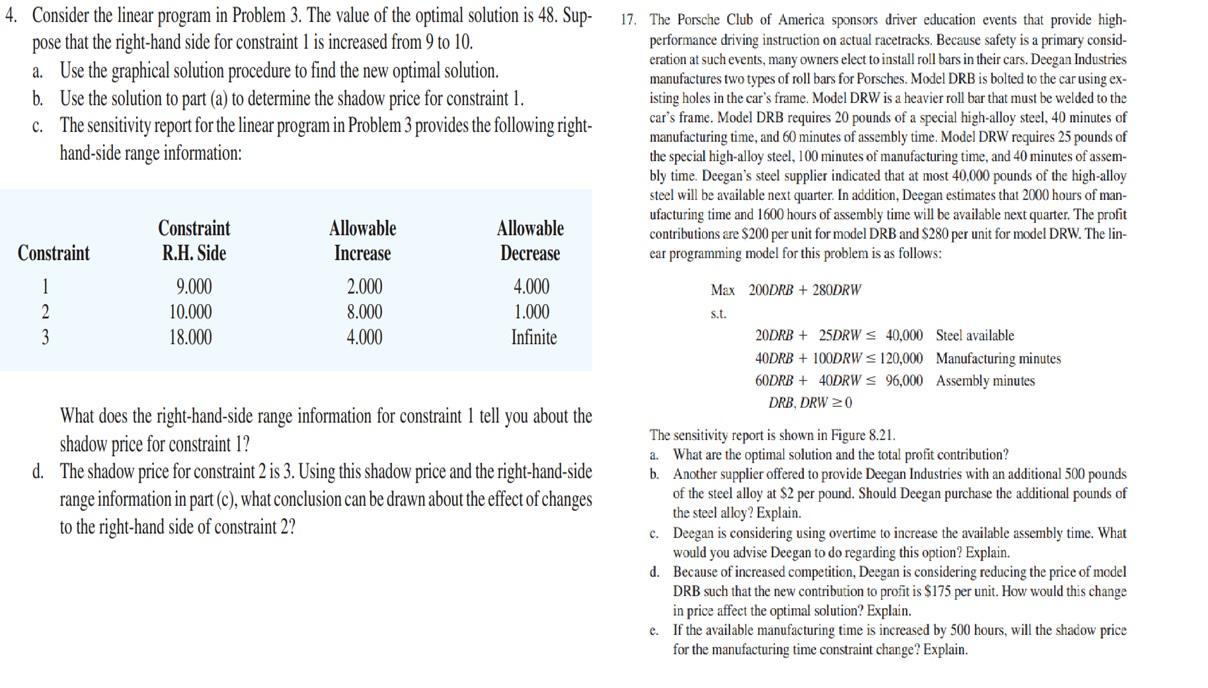

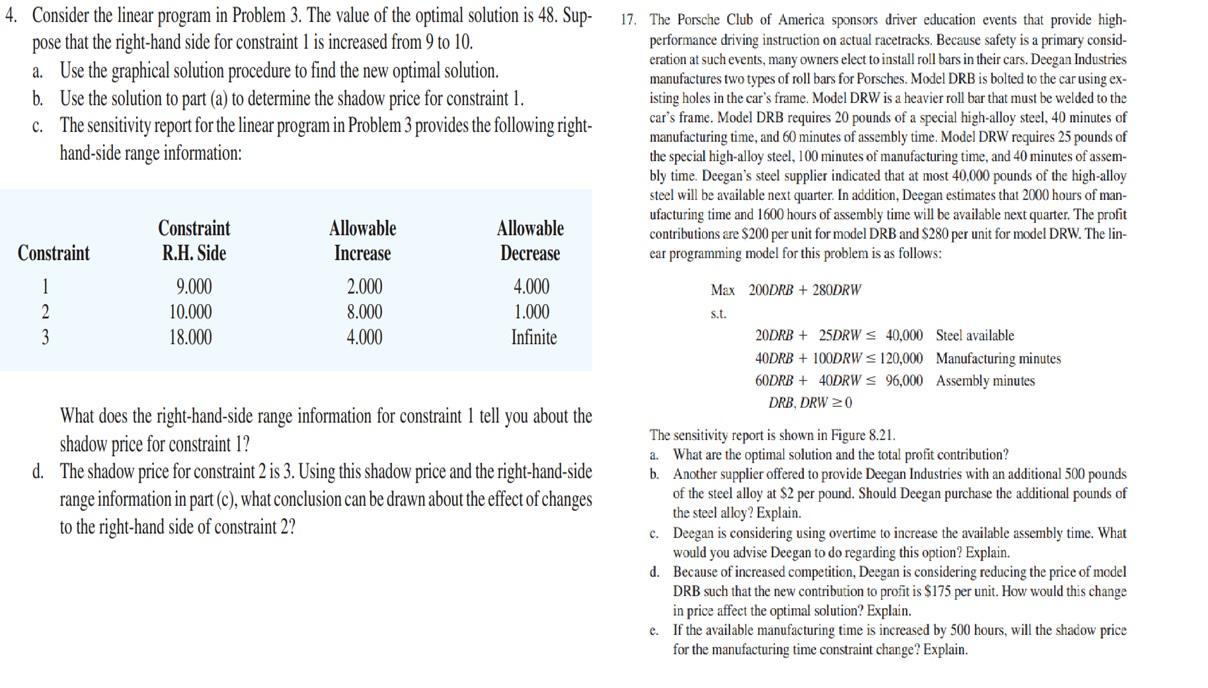

4. Consider the linear program in Problem 3. The value of the optimal solution is 48. Sup- pose that the right-hand side for constraint 1 is increased from 9 to 10. a. Use the graphical solution procedure to find the new optimal solution. b. Use the solution to part (a) to determine the shadow price for constraint 1. c. The sensitivity report for the linear program in Problem 3 provides the following right- hand-side range information: 17. The Porsche Club of America sponsors driver education events that provide high- performance driving instruction on actual racetracks. Because safety is a primary consid- eration at such events, many owners elect to install roll bars in their cars. Deegan Industries manufactures two types of roll bars for Porsches. Model DRB is bolted to the car using ex- isting holes in the car's frame. Model DRW is a heavier roll bar that must be welded to the car's frame. Model DRB requires 20 pounds of a special high-alloy steel, 40 minutes of manufacturing time, and 60 minutes of assembly time. Model DRW requires 25 pounds of the special high-alloy steel, 100 minutes of manufacturing time, and 40 minutes of assem- bly time. Deegan's steel supplier indicated that at most 40.000 pounds of the high-alloy steel will be available next quarter. In addition, Deegan estimates that 2000 hours of man- ufacturing time and 1600 hours of assembly time will be available next quarter. The profit contributions are $200 per unit for model DRB and $280 per unit for model DRW. The lin- ear programming model for this problem is as follows: Allowable Decrease Constraint Constraint R.H. Side 9.000 10.000 18.000 1 2 3 Allowable Increase 2.000 8.000 4.000 Max 200DRB + 280DRW 4.000 1.000 Infinite s.t. 20DRB + 25DRW 40,000 Steel available 40DRB + 100DRW = 120,000 Manufacturing minutes 60DRB + 40DRW S 96,000 Assembly minutes DRB, DRW 20 What does the right-hand-side range information for constraint I tell you about the shadow price for constraint I? d. The shadow price for constraint 2 is 3. Using this shadow price and the right-hand-side range information in part (c), what conclusion can be drawn about the effect of changes to the right-hand side of constraint 2? The sensitivity report is shown in Figure 8.21. What are the optimal solution and the total profit contribution? b. Another supplier offered to provide Deegan Industries with an additional 500 pounds of the steel alloy at $2 per pound. Should Deegan purchase the additional pounds of the steel alloy? Explain. c. Deegan is considering using overtime to increase the available assembly time. What would you advise Deegan to do regarding this option? Explain. d. Because of increased competition, Deegan is considering reducing the price of model DRB such that the new contribution to profit is $175 per unit. How would this change in price affect the optimal solution? Explain. e. If the available manufacturing time is increased by 500 hours, will the shadow price for the manufacturing time constraint change? Explain. 4. Consider the linear program in Problem 3. The value of the optimal solution is 48. Sup- pose that the right-hand side for constraint 1 is increased from 9 to 10. a. Use the graphical solution procedure to find the new optimal solution. b. Use the solution to part (a) to determine the shadow price for constraint 1. c. The sensitivity report for the linear program in Problem 3 provides the following right- hand-side range information: 17. The Porsche Club of America sponsors driver education events that provide high- performance driving instruction on actual racetracks. Because safety is a primary consid- eration at such events, many owners elect to install roll bars in their cars. Deegan Industries manufactures two types of roll bars for Porsches. Model DRB is bolted to the car using ex- isting holes in the car's frame. Model DRW is a heavier roll bar that must be welded to the car's frame. Model DRB requires 20 pounds of a special high-alloy steel, 40 minutes of manufacturing time, and 60 minutes of assembly time. Model DRW requires 25 pounds of the special high-alloy steel, 100 minutes of manufacturing time, and 40 minutes of assem- bly time. Deegan's steel supplier indicated that at most 40.000 pounds of the high-alloy steel will be available next quarter. In addition, Deegan estimates that 2000 hours of man- ufacturing time and 1600 hours of assembly time will be available next quarter. The profit contributions are $200 per unit for model DRB and $280 per unit for model DRW. The lin- ear programming model for this problem is as follows: Allowable Decrease Constraint Constraint R.H. Side 9.000 10.000 18.000 1 2 3 Allowable Increase 2.000 8.000 4.000 Max 200DRB + 280DRW 4.000 1.000 Infinite s.t. 20DRB + 25DRW 40,000 Steel available 40DRB + 100DRW = 120,000 Manufacturing minutes 60DRB + 40DRW S 96,000 Assembly minutes DRB, DRW 20 What does the right-hand-side range information for constraint I tell you about the shadow price for constraint I? d. The shadow price for constraint 2 is 3. Using this shadow price and the right-hand-side range information in part (c), what conclusion can be drawn about the effect of changes to the right-hand side of constraint 2? The sensitivity report is shown in Figure 8.21. What are the optimal solution and the total profit contribution? b. Another supplier offered to provide Deegan Industries with an additional 500 pounds of the steel alloy at $2 per pound. Should Deegan purchase the additional pounds of the steel alloy? Explain. c. Deegan is considering using overtime to increase the available assembly time. What would you advise Deegan to do regarding this option? Explain. d. Because of increased competition, Deegan is considering reducing the price of model DRB such that the new contribution to profit is $175 per unit. How would this change in price affect the optimal solution? Explain. e. If the available manufacturing time is increased by 500 hours, will the shadow price for the manufacturing time constraint change? Explain