Question: 4. Consider two bonds, a 10 -year bond paying an annual coupon of 10% and a 10 -year discount bond. Both bonds have a face

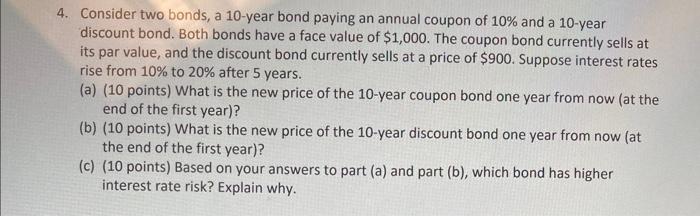

4. Consider two bonds, a 10 -year bond paying an annual coupon of 10% and a 10 -year discount bond. Both bonds have a face value of $1,000. The coupon bond currently sells at its par value, and the discount bond currently sells at a price of $900. Suppose interest rates rise from 10% to 20% after 5 years. (a) (10 points) What is the new price of the 10 -year coupon bond one year from now (at the end of the first year)? (b) ( 10 points) What is the new price of the 10 -year discount bond one year from now (at the end of the first year)? (c) (10 points) Based on your answers to part (a) and part (b), which bond has higher interest rate risk? Explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts