Question: 4. Currently, the company is not using EOQ and ROP values determined by the tools we are using but rather fixed Q and ROP

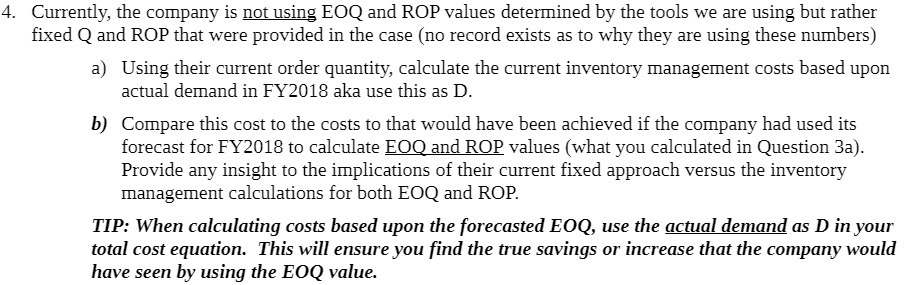

4. Currently, the company is not using EOQ and ROP values determined by the tools we are using but rather fixed Q and ROP that were provided in the case (no record exists as to why they are using these numbers) a) Using their current order quantity, calculate the current inventory management costs based upon actual demand in FY2018 aka use this as D. b) Compare this cost to the costs to that would have been achieved if the company had used its forecast for FY2018 to calculate EOQ and ROP values (what you calculated in Question 3a). Provide any insight to the implications of their current fixed approach versus the inventory management calculations for both EOQ and ROP. TIP: When calculating costs based upon the forecasted EOQ, use the actual demand as D in your total cost equation. This will ensure you find the true savings or increase that the company would have seen by using the EOQ value.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts