Question: 4 DECIMAL POINTS PLEASE, NO ROUNDING! You have to value a company based on its expected future cash flows. Interest rates are currently 17%. If

4 DECIMAL POINTS PLEASE, NO ROUNDING!

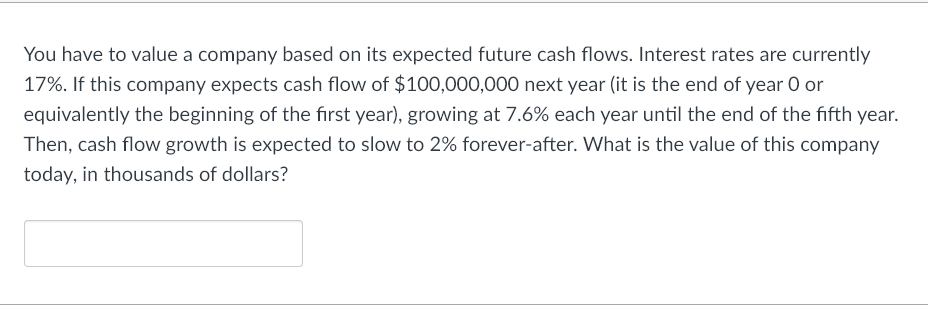

You have to value a company based on its expected future cash flows. Interest rates are currently 17%. If this company expects cash flow of $100,000,000 next year (it is the end of year 0 or equivalently the beginning of the first year), growing at 7.6% each year until the end of the fifth year. Then, cash flow growth is expected to slow to 2% forever-after. What is the value of this company today, in thousands of dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts