Question: 4. Does the relationship between your security and the market appear to be significantly different than zero? What evidence from the regression supports your conclusion?

4. Does the relationship between your security and the market appear to be significantly different than zero? What evidence from the regression supports your conclusion?

4. Does the relationship between your security and the market appear to be significantly different than zero? What evidence from the regression supports your conclusion?

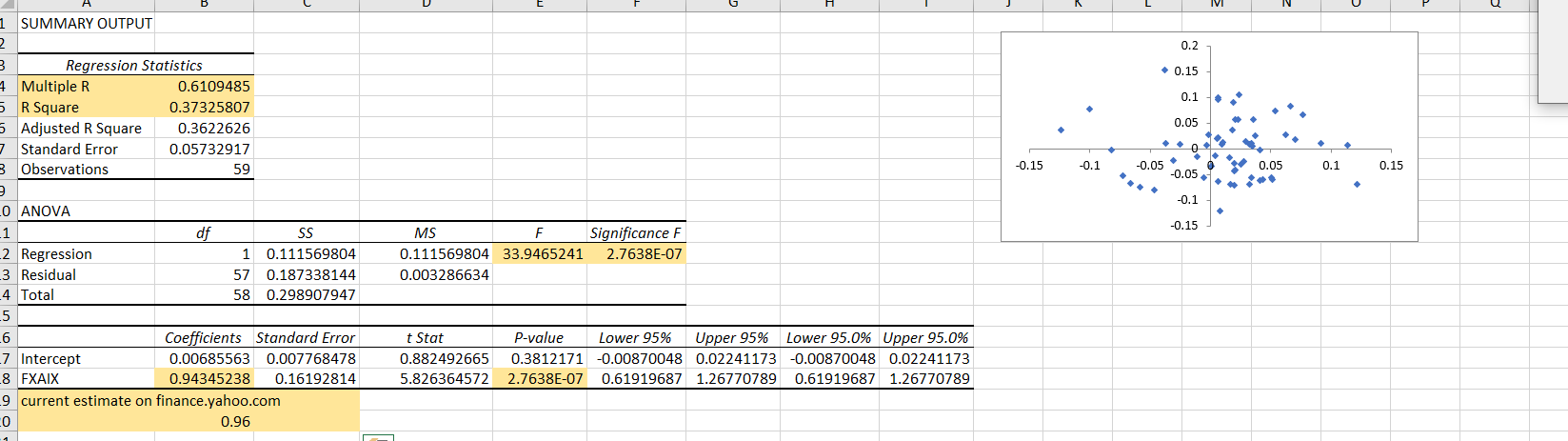

0.2 0.15 1 SUMMARY OUTPUT 2 3 Regression Statistics 4 Multiple R 0.6109485 5 R Square 0.37325807 5 Adjusted R Square 0.3622626 7 Standard Error 0.05732917 3 Observations 59 0.1 0.05 0 -0.15 -0.1 -0.05 0.05 0.1 0.15 -0.05 -0.1 -0.15 MS F Significance F 0.111569804 33.9465241 2.7638E-07 0.003286634 0 ANOVA 1 df SS -2 Regression 1 0.111569804 3 Residual 57 0.187338144 4 Total 58 0.298907947 5 6 Coefficients Standard Error 7 Intercept 0.00685563 0.007768478 8 FXAIX 0.94345238 0.16192814 9 current estimate on finance.yahoo.com CO 0.96 t Stat 0.882492665 5.826364572 P-value Lower 95% Upper 95% Lower 95.0% Upper 95.0% 0.3812171 -0.00870048 0.02241173 -0.00870048 0.02241173 2.7638E-07 0.61919687 1.26770789 0.61919687 1.26770789

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts