Question: 4. Emergency lending and quantitative easing In the following table, identify the short-term emergency lending facilities that enabled the Federal reserve to extend credit to

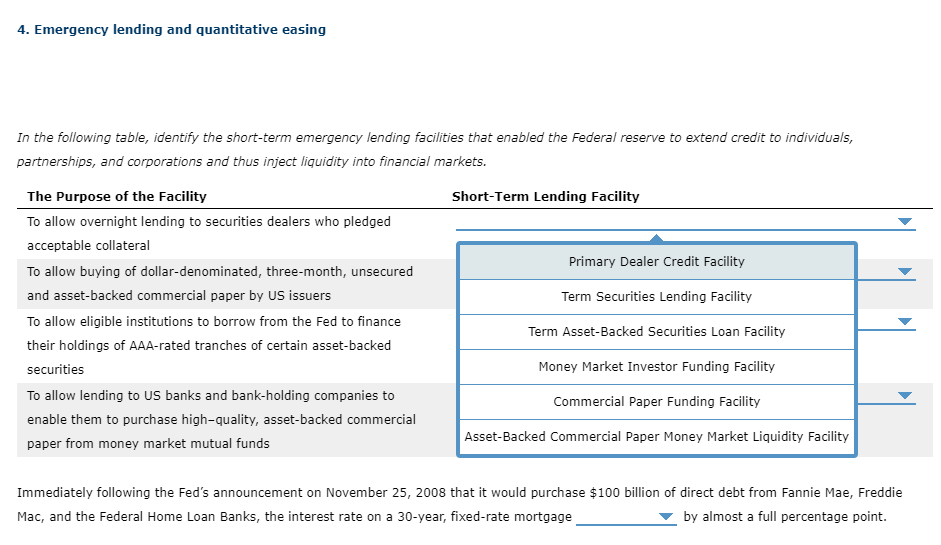

4. Emergency lending and quantitative easing In the following table, identify the short-term emergency lending facilities that enabled the Federal reserve to extend credit to individuals, partnerships, and corporations and thus inject liquidity into financial markets. Short-Term Lending Facility Primary Dealer Credit Facility Term Securities Lending Facility The Purpose of the Facility To allow overnight lending to securities dealers who pledged acceptable collateral To allow buying of dollar-denominated, three-month, unsecured and asset-backed commercial paper by US issuers To allow eligible institutions to borrow from the Fed to finance their holdings of AAA-rated tranches of certain asset-backed securities To allow lending to US banks and bank-holding companies to enable them to purchase high-quality, asset-backed commercial paper from money market mutual funds Term Asset-Backed Securities Loan Facility Money Market Investor Funding Facility Commercial Paper Funding Facility Asset-Backed Commercial Paper Money Market Liquidity Facility Immediately following the Fed's announcement on November 25, 2008 that it would purchase $100 billion of direct debt from Fannie Mae, Freddie Mac, and the Federal Home Loan Banks, the interest rate on a 30-year, fixed-rate mortgage by almost a full percentage point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts