Question: 4- (EU and Risk Diversification) A standard result for EU agents is that they always divesify their risks. You are asked to demonstrate this

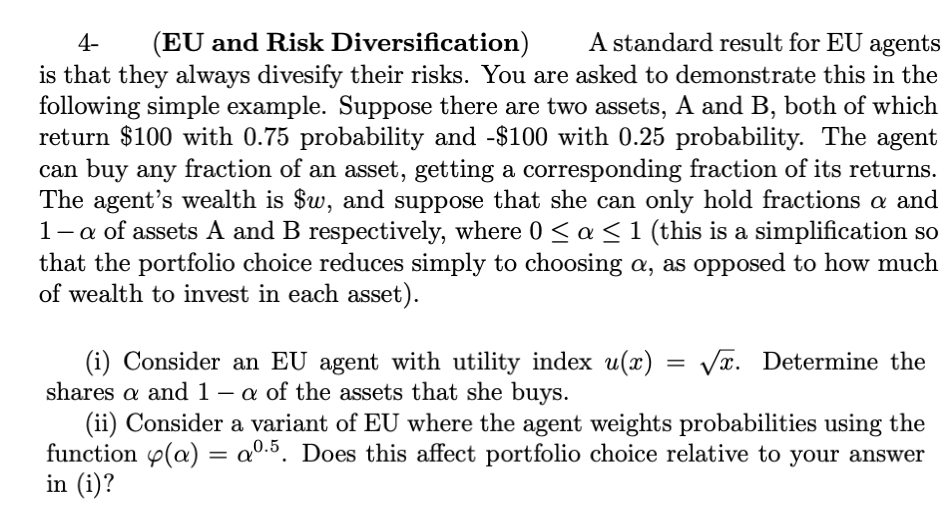

4- (EU and Risk Diversification) A standard result for EU agents is that they always divesify their risks. You are asked to demonstrate this in the following simple example. Suppose there are two assets, A and B, both of which return $100 with 0.75 probability and -$100 with 0.25 probability. The agent can buy any fraction of an asset, getting a corresponding fraction of its returns. The agent's wealth is $w, and suppose that she can only hold fractions a and 1-a of assets A and B respectively, where 0 a 1 (this is a simplification so that the portfolio choice reduces simply to choosing a, as opposed to how much of wealth to invest in each asset). (i) Consider an EU agent with utility index u(x)=x. Determine the shares a and 1-a of the assets that she buys. (ii) Consider a variant of EU where the agent weights probabilities using the function (a) = a0.5. Does this affect portfolio choice relative to your answer in (i)?

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

i For an EU agent with utility index ux x lets determine the shares a and 1 a of assets A and B that ... View full answer

Get step-by-step solutions from verified subject matter experts