Question: 4. Examine CNB's financial ratios and draw some basic conclusions about its performance. 5. What can be done to improve CNB's performance ? Total Deposit

4. Examine CNB's financial ratios and draw some basic conclusions about its performance. 5. What can be done to improve CNB's performance

?

?

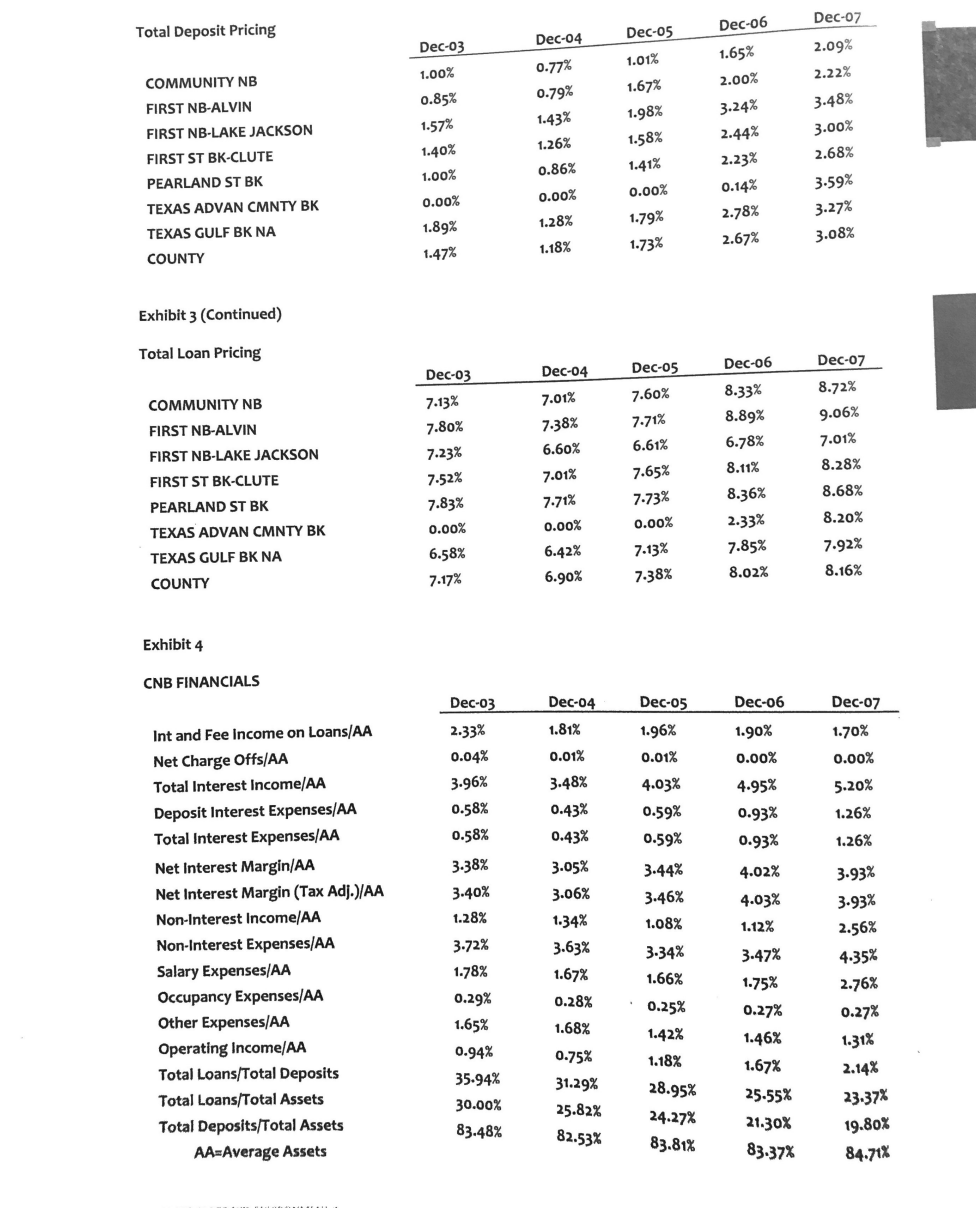

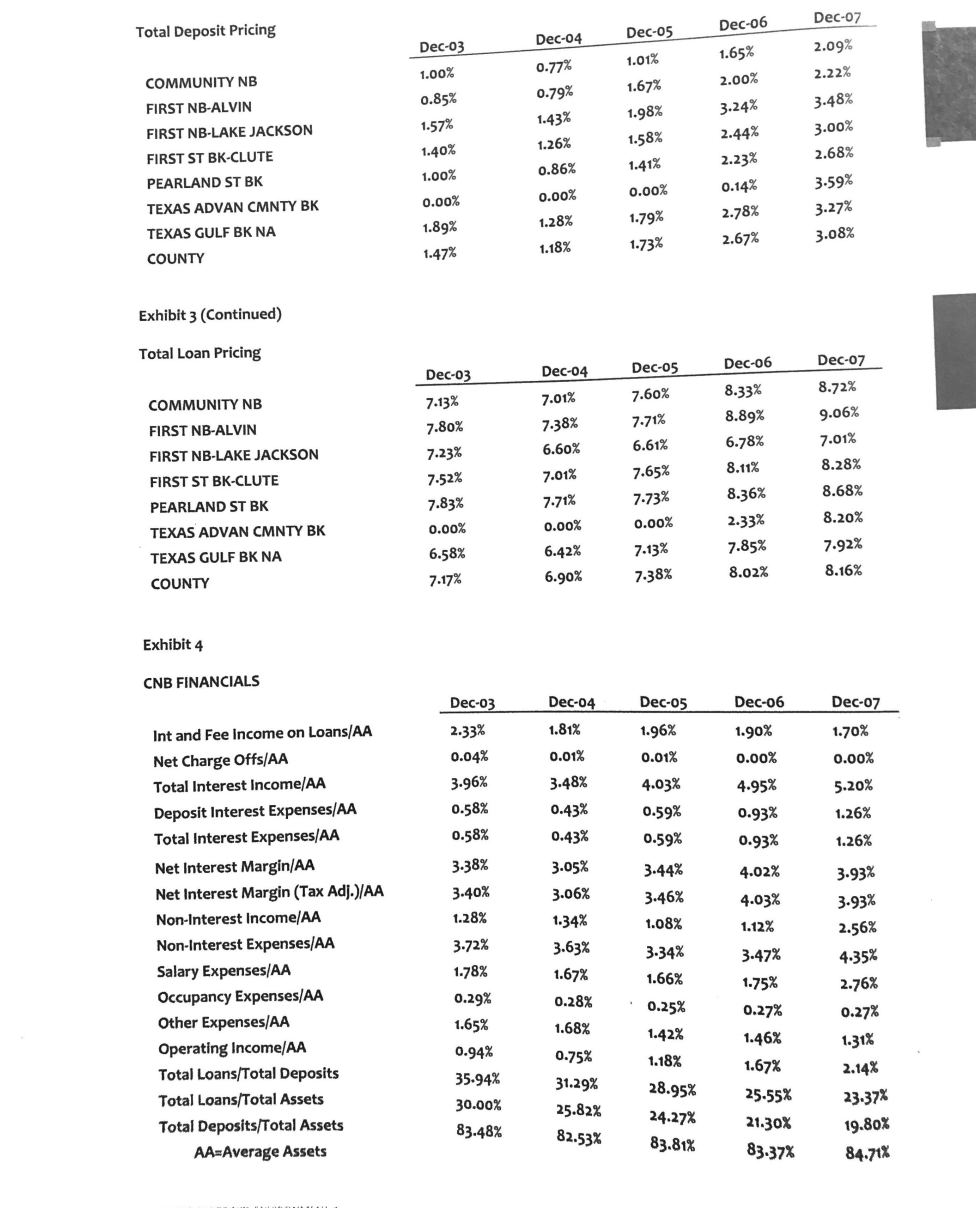

Total Deposit Pricing Exhibit 3 (Continued) Total Loan Pricing COMMUNITY NB FIRST NB-ALVIN FIRST NB-LAKE JACKSON FIRST ST BK-CLUTE PEARLAND ST BK TEXAS ADVAN CMNTY BK TEXAS GULF BK NA COUNTY Exhibit 4 CNB FINANCIALS \begin{tabular}{llllll} & & Dec-03 & & Dec-04 & Dec-05 \\ \cline { 2 - 6 } Int and Fee Income on Loans/AA & 2.33% & 1.81% & 1.96% & 1.90% & 1.70% \\ Net Charge Offs/AA & 0.04% & 0.01% & 0.01% & 0.00% & 0.00% \\ Total Interest Income/AA & 3.96% & 3.48% & 4.03% & 4.95% & 5.20% \\ Deposit Interest Expenses/AA & 0.58% & 0.43% & 0.59% & 0.93% & 1.26% \\ Total Interest Expenses/AA & 0.58% & 0.43% & 0.59% & 0.93% & 1.26% \\ Net Interest Margin/AA & 3.38% & 3.05% & 3.44% & 4.02% & 3.93% \\ Net Interest Margin (Tax Adj.)/AA & 3.40% & 3.06% & 3.46% & 4.03% & 3.93% \\ Non-Interest Income/AA & 1.28% & 1.34% & 1.08% & 1.12% & 2.56% \\ Non-Interest Expenses/AA & 3.72% & 3.63% & 3.34% & 3.47% & 4.35% \\ Salary Expenses/AA & 1.78% & 1.67% & 1.66% & 1.75% & 2.76% \\ Occupancy Expenses/AA & 0.29% & 0.28% & 0.25% & 0.27% & 0.27% \\ Other Expenses/AA & 1.65% & 1.68% & 1.42% & 1.46% & 1.31% \\ Operating Income/AA & 0.94% & 0.75% & 1.18% & 1.67% & 2.14% \\ Total Loans/Total Deposits & 35.94% & 31.29% & 28.95% & 25.55% & 23.37% \\ Total Loans/Total Assets & 30.00% & 25.82% & 24.27% & 21.30% & 19.80% \\ Total Deposits/Total Assets & 83.48% & 82.53% & 83.81% & 83.37% & 84.71% \end{tabular} Total Deposit Pricing Exhibit 3 (Continued) Total Loan Pricing COMMUNITY NB FIRST NB-ALVIN FIRST NB-LAKE JACKSON FIRST ST BK-CLUTE PEARLAND ST BK TEXAS ADVAN CMNTY BK TEXAS GULF BK NA COUNTY Exhibit 4 CNB FINANCIALS \begin{tabular}{llllll} & & Dec-03 & & Dec-04 & Dec-05 \\ \cline { 2 - 6 } Int and Fee Income on Loans/AA & 2.33% & 1.81% & 1.96% & 1.90% & 1.70% \\ Net Charge Offs/AA & 0.04% & 0.01% & 0.01% & 0.00% & 0.00% \\ Total Interest Income/AA & 3.96% & 3.48% & 4.03% & 4.95% & 5.20% \\ Deposit Interest Expenses/AA & 0.58% & 0.43% & 0.59% & 0.93% & 1.26% \\ Total Interest Expenses/AA & 0.58% & 0.43% & 0.59% & 0.93% & 1.26% \\ Net Interest Margin/AA & 3.38% & 3.05% & 3.44% & 4.02% & 3.93% \\ Net Interest Margin (Tax Adj.)/AA & 3.40% & 3.06% & 3.46% & 4.03% & 3.93% \\ Non-Interest Income/AA & 1.28% & 1.34% & 1.08% & 1.12% & 2.56% \\ Non-Interest Expenses/AA & 3.72% & 3.63% & 3.34% & 3.47% & 4.35% \\ Salary Expenses/AA & 1.78% & 1.67% & 1.66% & 1.75% & 2.76% \\ Occupancy Expenses/AA & 0.29% & 0.28% & 0.25% & 0.27% & 0.27% \\ Other Expenses/AA & 1.65% & 1.68% & 1.42% & 1.46% & 1.31% \\ Operating Income/AA & 0.94% & 0.75% & 1.18% & 1.67% & 2.14% \\ Total Loans/Total Deposits & 35.94% & 31.29% & 28.95% & 25.55% & 23.37% \\ Total Loans/Total Assets & 30.00% & 25.82% & 24.27% & 21.30% & 19.80% \\ Total Deposits/Total Assets & 83.48% & 82.53% & 83.81% & 83.37% & 84.71% \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts