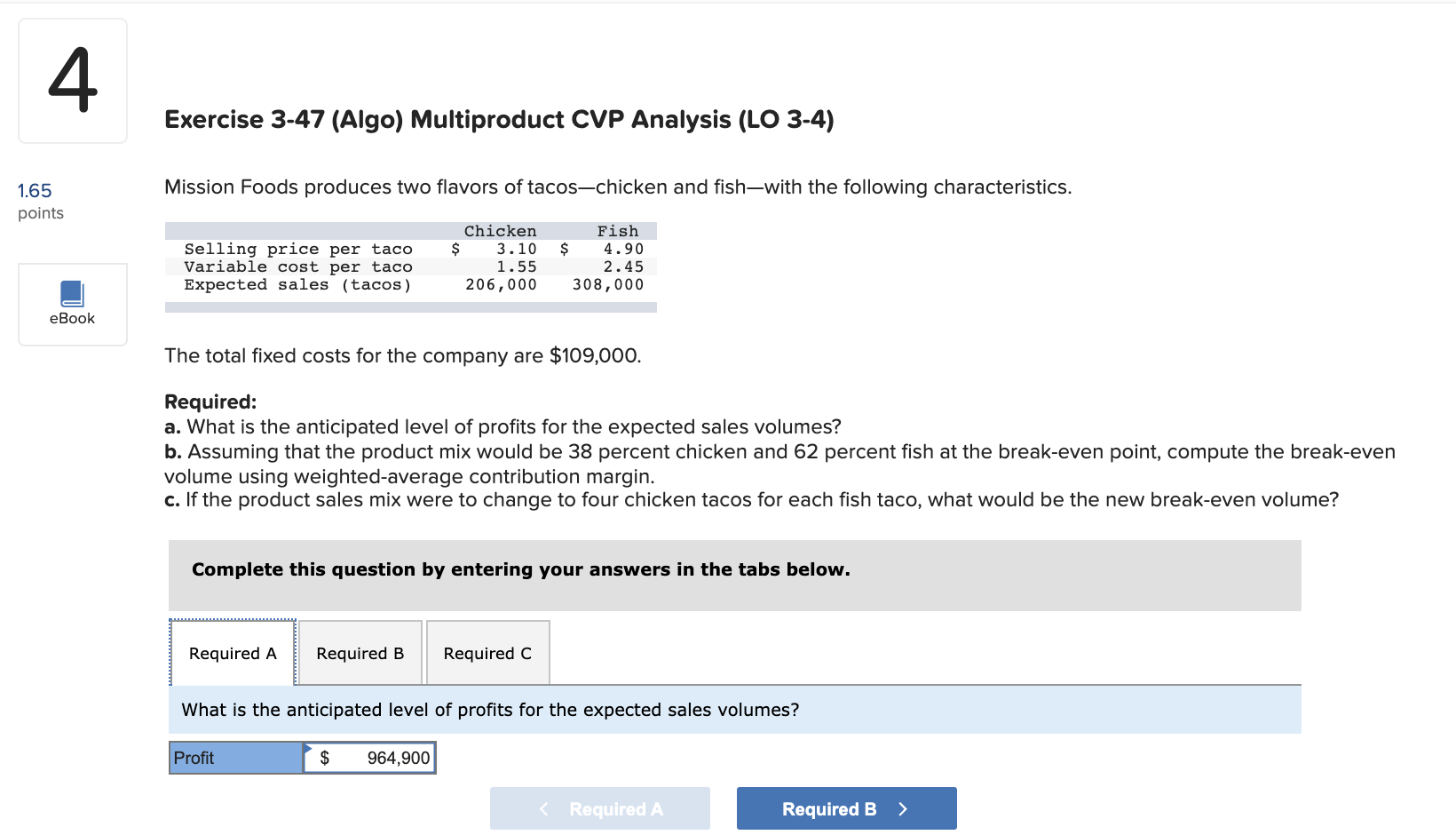

Question: 4 Exercise 3-47 (Algo) Multiproduct CVP Analysis (LO 3-4) Mission Foods produces two flavors of tacos-chicken and fishwith the following characteristics. 1.65 points 4.90 Selling

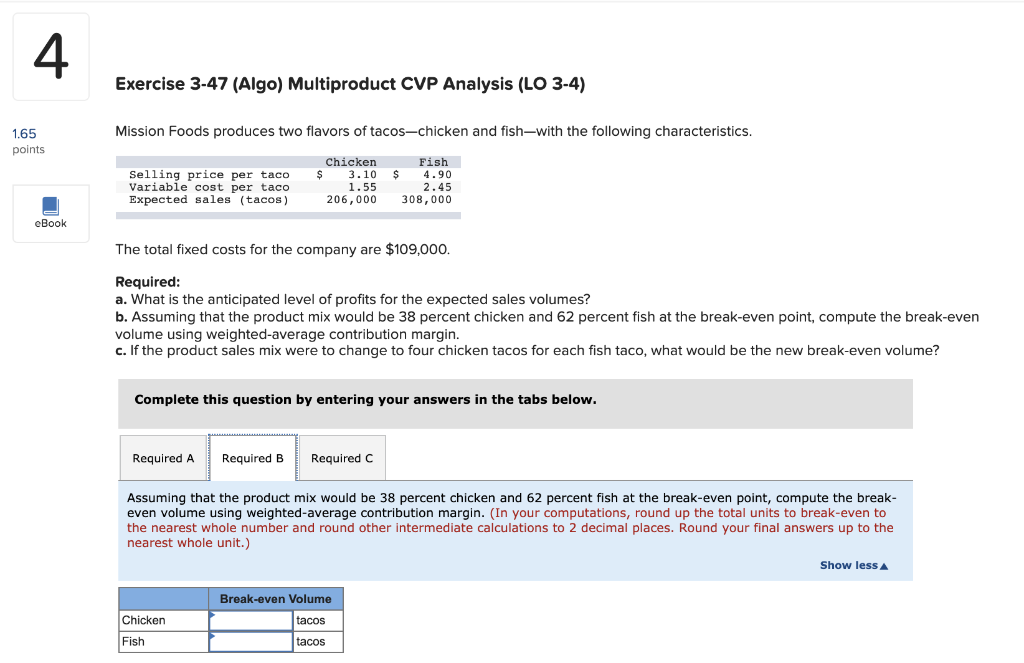

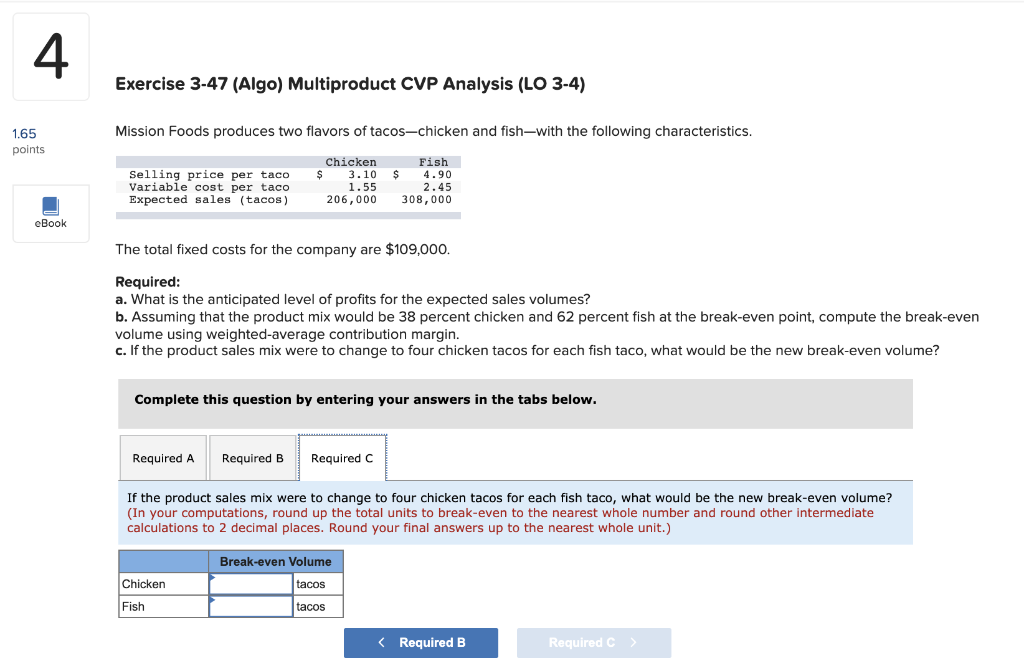

4 Exercise 3-47 (Algo) Multiproduct CVP Analysis (LO 3-4) Mission Foods produces two flavors of tacos-chicken and fishwith the following characteristics. 1.65 points 4.90 Selling price per taco Variable cost per taco Expected sales (tacos) Chicken $ 3.10 1.55 206,000 Fish $ 2.45 308,000 eBook The total fixed costs for the company are $109,000. Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the product mix would be 38 percent chicken and 62 percent fish at the break-even point, compute the break-even volume using weighted-average contribution margin. c. If the product sales mix were to change to four chicken tacos for each fish taco, what would be the new break-even volume? Complete this question by entering your answers in the tabs below. Required A Required B Required C What is the anticipated level of profits for the expected sales volumes? Profit $ 964,900 Required A Required B > 4 Exercise 3-47 (Algo) Multiproduct CVP Analysis (LO 3-4) Mission Foods produces two flavors of tacos-chicken and fish with the following characteristics. 1.65 points Selling price per taco Variable cost per taco Expected sales (tacos) Chicken $ 3.10 1.55 206,000 Fish $ 4.90 2.45 308,000 eBook The total fixed costs for the company are $109,000. Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the product mix would be 38 percent chicken and 62 percent fish at the break-even point, compute the break-even volume using weighted average contribution margin. c. If the product sales mix were to change to four chicken tacos for each fish taco, what would be the new break-even volume? Complete this question by entering your answers in the tabs below. Required A Required B Required C Assuming that the product mix would be 38 percent chicken and 62 percent fish at the break-even point, compute the break- even volume using weighted-average contribution margin. (In your computations, round up the total units to break-even to the nearest whole number and round other intermediate calculations to 2 decimal places. Round your final answers up to the nearest whole unit.) Show less Break-even Volume Chicken tacos tacos Fish 4 Exercise 3-47 (Algo) Multiproduct CVP Analysis (LO 3-4) Mission Foods produces two flavors of tacos-chicken and fish with the following characteristics. 1.65 points Selling price per taco Variable cost per taco Expected sales (tacos) Chicken $ 3.10 1.55 206,000 Fish $ 4.90 2.45 308,000 eBook The total fixed costs for the company are $109,000. Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the product mix would be 38 percent chicken and 62 percent fish at the break-even point, compute the break-even volume using weighted average contribution margin. c. If the product sales mix were to change to four chicken tacos for each fish taco, what would be the new break-even volume? Complete this question by entering your answers in the tabs below. Required A Required B Required C If the product sales mix were to change to four chicken tacos for each fish taco, what would be the new break-even volume? (In your computations, round up the total units to break-even to the nearest whole number and round other intermediate calculations to 2 decimal places. Round your final answers up to the nearest whole unit.) Break-even Volume Chicken tacos Fish tacos

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts