Question: 4 Exercise 6.19 Equivalent Units: FIFO Method Using the data from Exercise 6.18, compute the equivalent units of production for each of the four departments

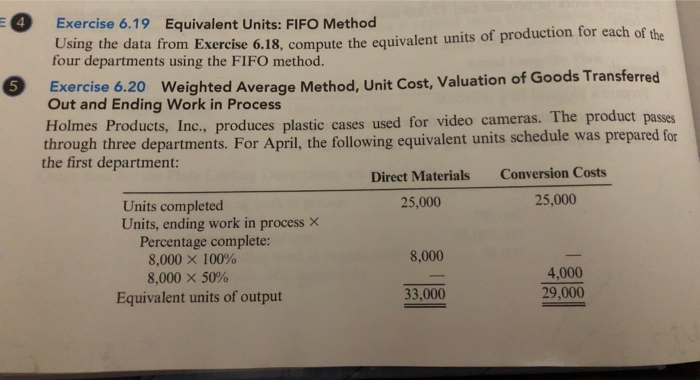

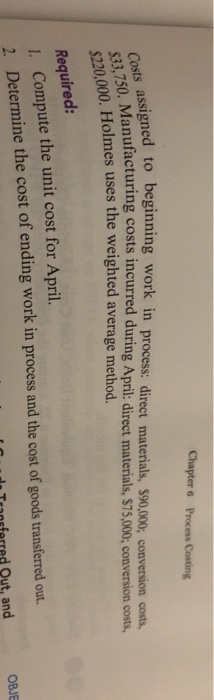

4 Exercise 6.19 Equivalent Units: FIFO Method Using the data from Exercise 6.18, compute the equivalent units of production for each of the four departments using the FIFO method. Exercise 6.20 Weighted Average Method, Unit Cost, Valuation of Goods Transferred Out and Ending Work in Process Holmes Products, Inc., produces plastic cases used for video cameras. The product passes through three departments. For April, the following equivalent units schedule was prepared for the first department: Direct Materials Conversion Costs Units completed 25,000 25,000 Units, ending work in process X Percentage complete: 8,000 X 100% 8,000 8,000 X 50% Equivalent units of output 33,000 29.000 Chapter 6 Process Costing Costs assigned to $33,750. Manufactu $220,000. Holme signed to beginning work in process: direct materials. $90,000; conversion costs. Manufacturing costs incurred during April: direct materials, $75,000; conversion costs. 000. Holmes uses the weighted average method. Required: 1. Compute the unit cost for April. Determine the cost of ending work in process and the cost of goods transferred out. Transferred Out, and OBJE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts