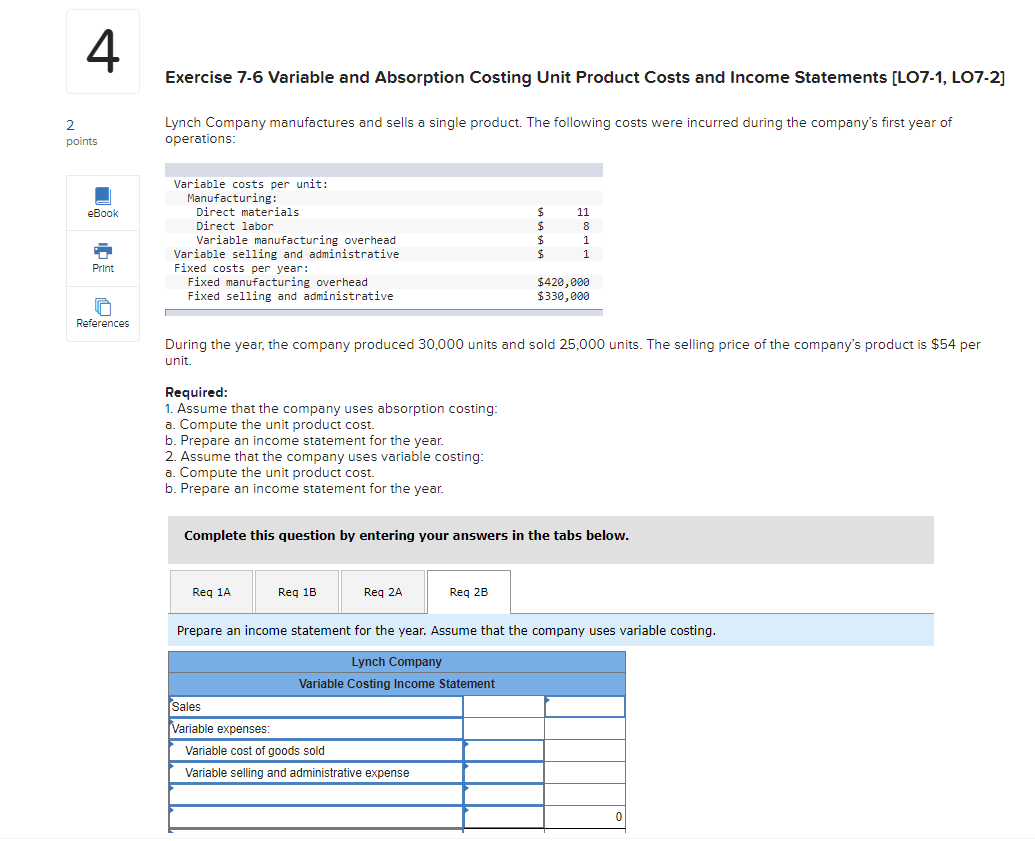

Question: 4 Exercise 7-6 Variable and Absorption Costing Unit Product Costs and Income Statements [LO7-1, L07-2] 2 points Lynch Company manufactures and sells a single product.

![Income Statements [LO7-1, L07-2] 2 points Lynch Company manufactures and sells a](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66dbfe0af183f_45066dbfe0a8f30f.jpg)

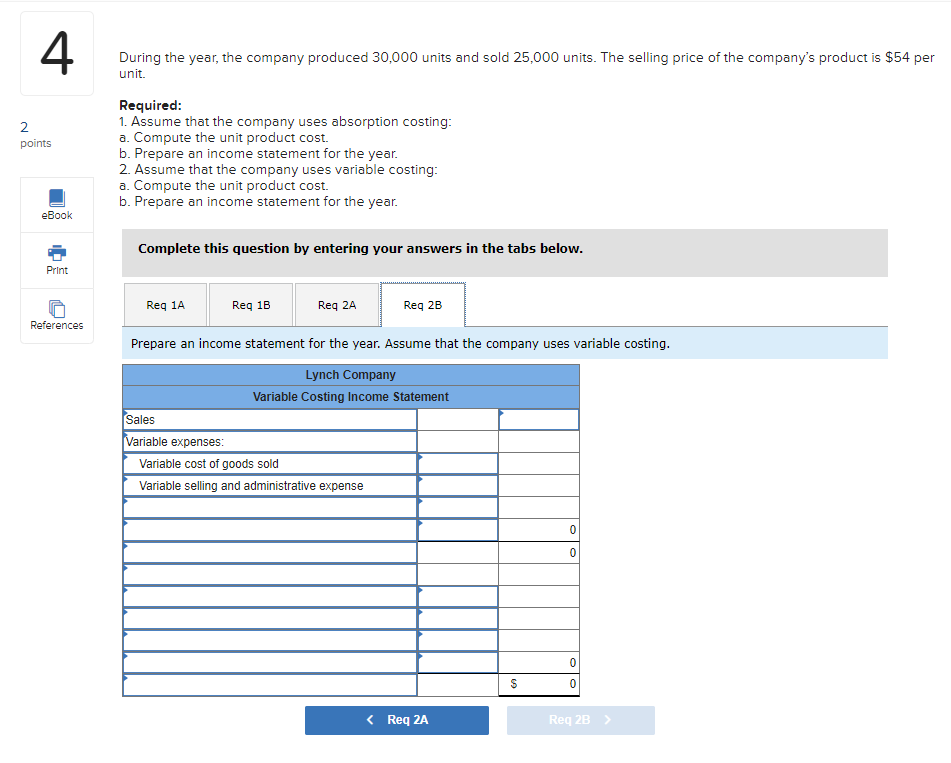

4 Exercise 7-6 Variable and Absorption Costing Unit Product Costs and Income Statements [LO7-1, L07-2] 2 points Lynch Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations: eBook 11 $ $ Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative 1 1 $ Print $420,000 $330,000 References During the year, the company produced 30,000 units and sold 25,000 units. The selling price of the company's product is $54 per unit. Required: 1. Assume that the company uses absorption costing: a. Compute the unit product cost. b. Prepare an income statement for the year. 2. Assume that the company uses variable costing: a. Compute the unit product cost. b. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 2A Reg 2B Prepare an income statement for the year. Assume that the company uses variable costing. Lynch Company Variable Costing Income Statement Sales Variable expenses: Variable cost of goods sold Variable selling and administrative expense 0 4 Exercise 7-6 Variable and Absorption Costing Unit Product Costs and Income Statements [LO7-1, LO7-2] 2 points Lynch Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations: eBook Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative $ $ $ $ 11 8 1 1 Print $420,000 $330,000 References During the year, the company produced 30,000 units and sold 25,000 units. The selling price of the company's product is $54 per unit. Required: 1. Assume that the company uses absorption costing: a. Compute the unit product cost. b. Prepare an income statement for the year. 2. Assume that the company uses variable costing: a. Compute the unit product cost. b. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Req 2A Reg 2B Prepare an income statement for the year. Assume that the company uses absorption costing. Lynch Company Absorption Costing Income Statement Sales $ 1,350,000 Cost of goods sold 850,000 Gross margin 500.000 Selling and administrative expense 110,000 Net operating income $ 390,000 4 During the year, the company produced 30,000 units and sold 25,000 units. The selling price of the company's product is $54 per unit. 2 points Required: 1. Assume that the company uses absorption costing: a. Compute the unit product cost. b. Prepare an income statement for the year. 2. Assume that the company uses variable costing: a. Compute the unit product cost. b. Prepare an income statement for the year. eBook Complete this question by entering your answers in the tabs below. Print Req 1A Req 1B Req 2A Req 2B References Prepare an income statement for the year. Assume that the company uses variable costing. Lynch Company Variable Costing Income Statement Sales Variable expenses: Variable cost of goods sold Variable selling and administrative expense 0 0 0 S 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts