Question: 4. Explain what an arbitrageur would do in the following circumstances. - S/SF exchange rate is $.51/SF, the Swiss risk-free rate is 4% per year,

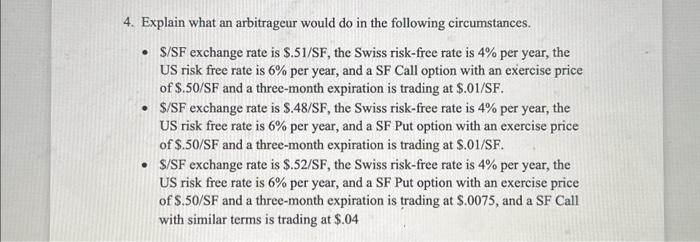

4. Explain what an arbitrageur would do in the following circumstances. - S/SF exchange rate is $.51/SF, the Swiss risk-free rate is 4% per year, the US risk free rate is 6% per year, and a SF Call option with an exercise price of $.50/SF and a three-month expiration is trading at $.01/SF. - $ /SF exchange rate is $.48/SF, the Swiss risk-free rate is 4% per year, the US risk free rate is 6% per year, and a SF Put option with an exercise price of $.50/SF and a three-month expiration is trading at \$.01/SF. - $ S/SF exchange rate is $.52/SF, the Swiss risk-free rate is 4% per year, the US risk free rate is 6% per year, and a SF Put option with an exercise price of $.50/SF and a three-month expiration is trading at \$.0075, and a SF Call with similar terms is trading at $.04

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts