Question: 4. Face Co. uses the US dollar as its functional currency in Country X. At December 31, 2015 Face's subsidiary has a net asset position

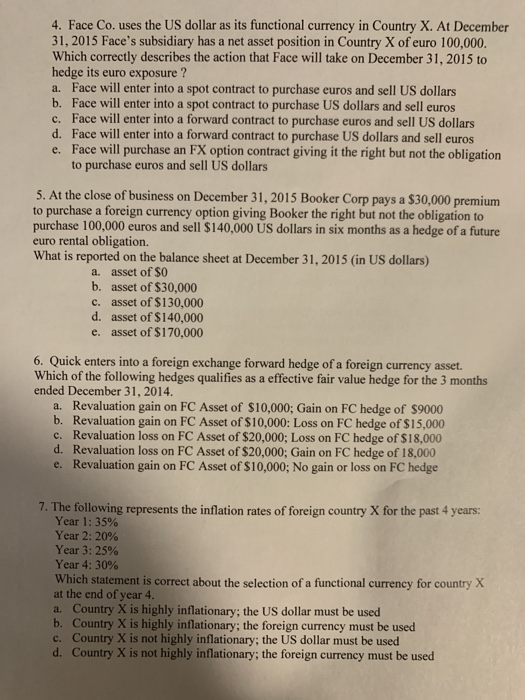

4. Face Co. uses the US dollar as its functional currency in Country X. At December 31, 2015 Face's subsidiary has a net asset position in Country X of euro 100,000. Which correctly describes the action that Face will take on December 31, 2015 to hedge its euro exposure ? a. Face will enter into a spot contract to purchase euros and sell US dollars b. Face will enter into a spot contract to purchase US dollars and sell euros c. Face will enter into a forward contract to purchase euros and sell US dollars d. Face will enter into a forward contract to purchase US dollars and sell euros e. Face will purchase an FX option contract giving it the right but not the obligation to purchase euros and sell US dollars 5. At the close of business on December 31, 2015 Booker Corp pays a $30,000 premium to purchase a foreign currency option giving Booker the right but not the obligation to purchase 100.000 euros and sell $140,000 US dollars in six months as a hedge of a future euro rental obligation. What is reported on the balance sheet at December 31, 2015 in US dollars) a. asset of $0 b. asset of $30,000 c. asset of $130,000 d. asset of $140,000 e. asset of $170,000 6. Quick enters into a foreign exchange forward hedge of a foreign currency asset. Which of the following hedges qualifies as a effective fair value hedge for the 3 months ended December 31, 2014. a. Revaluation gain on FC Asset of $10,000; Gain on FC hedge of $9000 b. Revaluation gain on FC Asset of $10,000: Loss on FC hedge of $15,000 c. Revaluation loss on FC Asset of $20,000; Loss on FC hedge of $18,000 d. Revaluation loss on FC Asset of $20,000; Gain on FC hedge of 18,000 e. Revaluation gain on FC Asset of $10,000; No gain or loss on FC hedge 7. The following represents the inflation rates of foreign country X for the past 4 years: Year 1: 35% Year 2: 20% Year 3: 25% Year 4: 30% Which statement is correct about the selection of a functional currency for country X at the end of year 4. a. Country X is highly inflationary; the US dollar must be used b. Country X is highly inflationary; the foreign currency must be used c. Country X is not highly inflationary; the US dollar must be used d. Country X is not highly inflationary; the foreign currency must be used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts