Question: 4. [Financial Risk and Return Considerations) Explain how you would choose between the following situations. Develop your answers from the perspective of the principles of

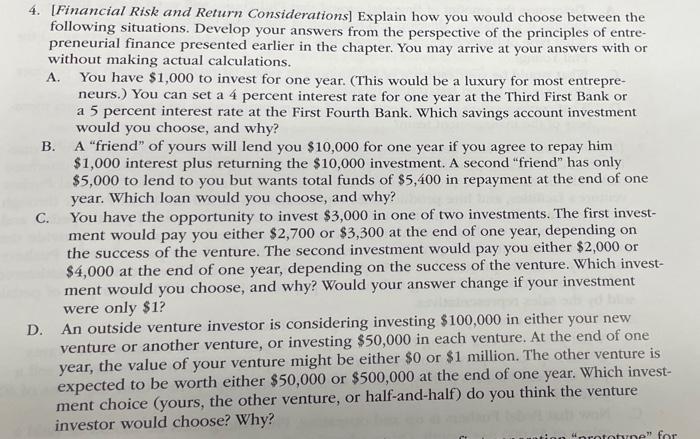

4. [Financial Risk and Return Considerations) Explain how you would choose between the following situations. Develop your answers from the perspective of the principles of entre- preneurial finance presented earlier in the chapter. You may arrive at your answers with or without making actual calculations. A You have $1,000 to invest for one year. This would be a luxury for most entrepre- neurs.) You can set a 4 percent interest rate for one year at the Third First Bank or a 5 percent interest rate at the First Fourth Bank. Which savings account investment would you choose, and why? B. A "friend" of yours will lend you $10,000 for one year if you agree to repay him $1,000 interest plus returning the $10,000 investment. A second "friend" has only $5,000 to lend to you but wants total funds of $5,400 in repayment at the end of one year. Which loan would you choose, and why? C. You have the opportunity to invest $3,000 in one of two investments. The first invest- ment would pay you either $2,700 or $3,300 at the end of one year, depending on the success of the venture. The second investment would pay you either $2,000 or $4,000 at the end of one year, depending on the success of the venture. Which invest- ment would you choose, and why? Would your answer change if your investment were only $12 D. An outside venture investor is considering investing $100,000 in either your new venture or another venture, or investing $50,000 in each venture. At the end of one year, the value of your venture might be either $0 or $1 million. The other venture is expected to be worth either $50,000 or $500,000 at the end of one year. Which invest- ment choice (yours, the other venture, or half-and-half) do you think the venture investor would choose? Why? prototyne" for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts