Question: 4. First securities bank faces increasing needs for capital. Fortunately, it has an Ay credit rating. Manager is trying to determine the bank's current weighted

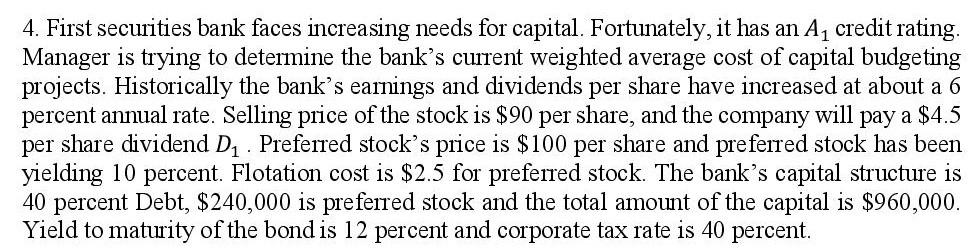

4. First securities bank faces increasing needs for capital. Fortunately, it has an Ay credit rating. Manager is trying to determine the bank's current weighted average cost of capital budgeting projects. Historically the bank's earnings and dividends per share have increased at about a 6 percent annual rate. Selling price of the stock is $90 per share, and the company will pay a $4.5 per share dividend Dj . Preferred stock's price is $100 per share and preferred stock has been yielding 10 percent. Flotation cost is $2.5 for preferred stock. The bank's capital structure is 40 percent Debt, $240,000 is preferred stock and the total amount of the capital is $960,000. Yield to maturity of the bond is 12 percent and corporate tax rate is 40 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts