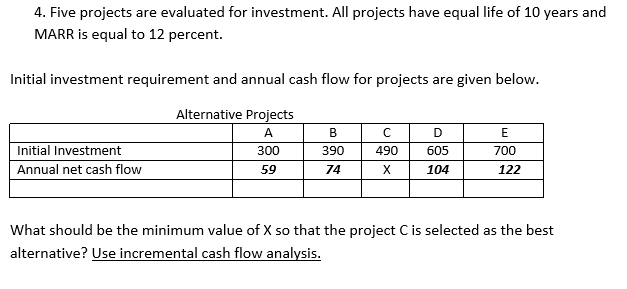

Question: 4. Five projects are evaluated for investment. All projects have equal life of 10 years and MARR is equal to 12 percent. Initial investment requirement

4. Five projects are evaluated for investment. All projects have equal life of 10 years and MARR is equal to 12 percent. Initial investment requirement and annual cash flow for projects are given below. Alternative Projects 300 B 390 490 X Initial Investment Annual net cash flow D 605 104 E 700 59 74 122 What should be the minimum value of X so that the project C is selected as the best alternative? Use incremental cash flow analysis

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock