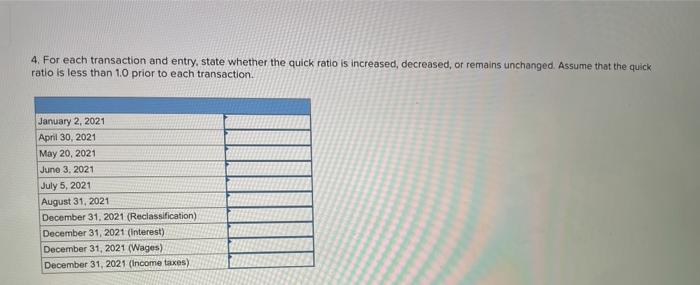

Question: 4. For each transaction and entry, state whether the quick ratio is increased, decreased, or remains unchanged. Assume that the quick ratio is less than

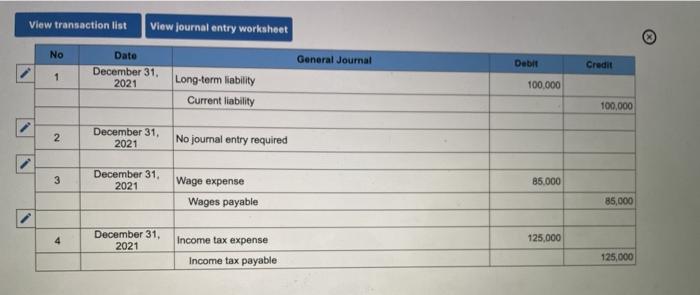

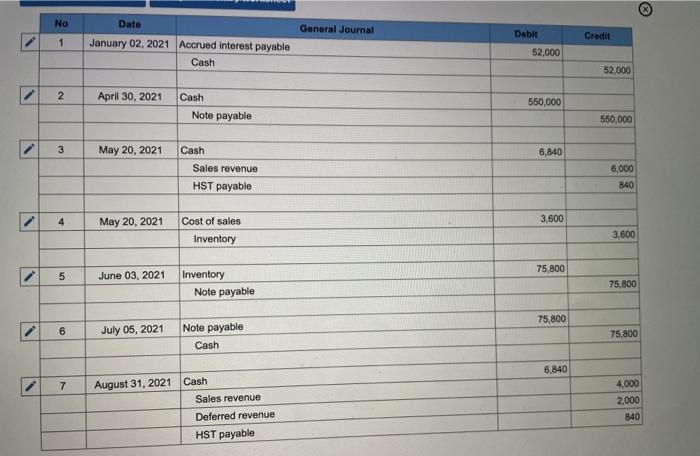

4. For each transaction and entry, state whether the quick ratio is increased, decreased, or remains unchanged. Assume that the quick ratio is less than 10 prior to each transaction January 2, 2021 April 30, 2021 May 20, 2021 June 3, 2021 July 5, 2021 August 31, 2021 December 31, 2021 (Reclassification) December 31, 2021 (Interest) December 31, 2021 (Wages) December 31, 2021 (Income taxes) View transaction list View journal entry worksheet No General Journal Debit Credit Date December 31, 2021 1 Long-term liability Current liability 100.000 100,000 2 December 31, 2021 No journal entry required 3 December 31, 2021 85.000 Wage expense Wages payable 85,000 4 December 31, 2021 Income tax expense 125,000 Income tax payable 125,000 No Date General Journal Credit 1 January 02, 2021 Accrued interest payable Cash Debit 52,000 52.000 2 April 30, 2021 550,000 Cash Note payable 550,000 3 May 20, 2021 6,840 Cash Sales revenue HST payable 6,000 840 4 May 20, 2021 3,600 Cost of sales Inventory 3,600 75,800 5 June 03, 2021 Inventory Note payable 75,800 75,800 6 July 05, 2021 Note payable Cash 75,800 6,840 7 August 31, 2021 Cash Sales revenue Deferred revenue HST payable 4,000 2,000 840

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts