Question: 4. Given the bond yields on 8/15/2018, plot the yield curve and the term structure of interest Tates. Assume the bonds in the table below

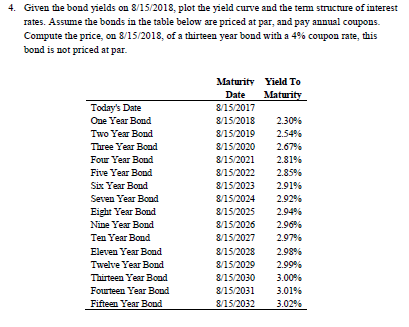

4. Given the bond yields on 8/15/2018, plot the yield curve and the term structure of interest Tates. Assume the bonds in the table below are priced at par, and pay annual coupons. Compute the price, om 8/15/2018, of a thirteen year bond with a 4% coupon rate, this bond is not priced at par. Today's Date One Year Bond Two Year Bond Three Year Boud Four Year Bond Five Year Bond Six Year Bond Seven Year Bond Eight Year Bond Nine Year Bond Ten Year Bond Eleven Year Boud Twelve Year Boud Thirteen Year Bond Fourteen Year Bond Fifteen Year Bond Maturity Yield To Date Maturity 8/15/2017 8/15/2018 2.30% 8/15/2019 2.549 8/15/2020 2.67% 8/15/2021 2.81% 8/15/2022 2.85% 8/15/2023 2.91% 8/15/2024 2.92 8/15/2025 2.94% 8/15/2026 2.96% 8/15/2027 2.979 8/15/2028 2.98% 8/15/2029 2.99% 8/15/2030 3.00% 8/15/2031 3.01% 8/15/2032 3.02% 4. Given the bond yields on 8/15/2018, plot the yield curve and the term structure of interest Tates. Assume the bonds in the table below are priced at par, and pay annual coupons. Compute the price, om 8/15/2018, of a thirteen year bond with a 4% coupon rate, this bond is not priced at par. Today's Date One Year Bond Two Year Bond Three Year Boud Four Year Bond Five Year Bond Six Year Bond Seven Year Bond Eight Year Bond Nine Year Bond Ten Year Bond Eleven Year Boud Twelve Year Boud Thirteen Year Bond Fourteen Year Bond Fifteen Year Bond Maturity Yield To Date Maturity 8/15/2017 8/15/2018 2.30% 8/15/2019 2.549 8/15/2020 2.67% 8/15/2021 2.81% 8/15/2022 2.85% 8/15/2023 2.91% 8/15/2024 2.92 8/15/2025 2.94% 8/15/2026 2.96% 8/15/2027 2.979 8/15/2028 2.98% 8/15/2029 2.99% 8/15/2030 3.00% 8/15/2031 3.01% 8/15/2032 3.02%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts