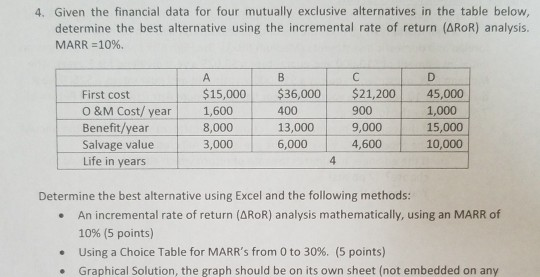

Question: 4. Given the financial data for four mutually exclusive alternatives in the table below, determine the best alternative using the incremental rate of return (ARoR)

4. Given the financial data for four mutually exclusive alternatives in the table below, determine the best alternative using the incremental rate of return (ARoR) analysis. MARR 10%. $15,000 $36,000 45,000 1,000 15,000 6,000 4,600 10,000 $21,200 900 9,000 First cost O &M Cost/year1,600 Benefit/year Salvage value Life in years 400 13,000 8,000 3,000 4 Determine the best alternative using Excel and the following methods: .An incremental rate of return (ARoR) analysis mathematically, using an MARR of 10% (5 points) . Using a Choice Table for MARR's from 0 to 30%. (5 points) . Graphical Solution, the graph should be on its own sheet (not embedded on any 4. Given the financial data for four mutually exclusive alternatives in the table below, determine the best alternative using the incremental rate of return (ARoR) analysis. MARR 10%. $15,000 $36,000 45,000 1,000 15,000 6,000 4,600 10,000 $21,200 900 9,000 First cost O &M Cost/year1,600 Benefit/year Salvage value Life in years 400 13,000 8,000 3,000 4 Determine the best alternative using Excel and the following methods: .An incremental rate of return (ARoR) analysis mathematically, using an MARR of 10% (5 points) . Using a Choice Table for MARR's from 0 to 30%. (5 points) . Graphical Solution, the graph should be on its own sheet (not embedded on any

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts