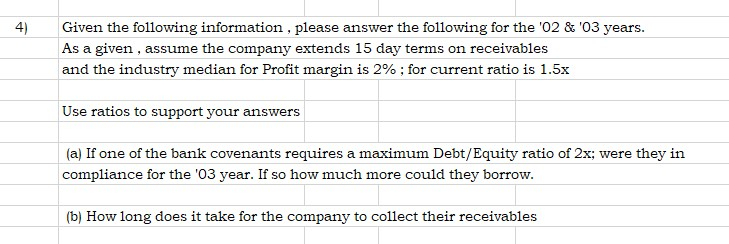

Question: 4) Given the following information, please answer the following for the '02 & '03 years As a given, assume the company extends 15 day terms

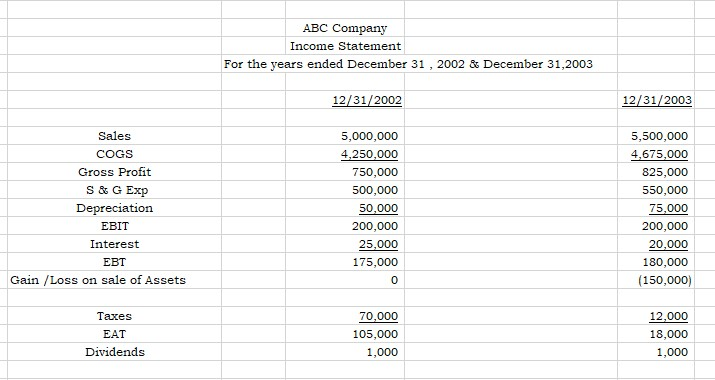

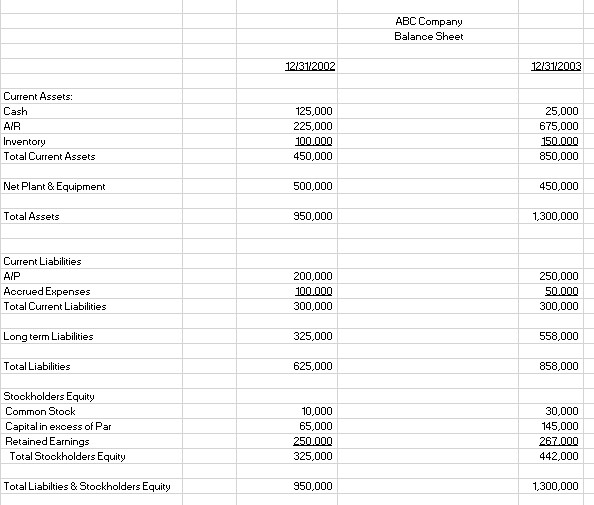

4) Given the following information, please answer the following for the '02 & '03 years As a given, assume the company extends 15 day terms on receivables and the industry median for Profit margin is 2% ; for current ratio is 1.5x Use ratios to support your answers (a) If one of the bank covenants requires a maximum Debt/Equity ratio of 2x; were they in compliance for the 03 year. If so how much more could they borrow. (b) How long does it take for the company to collect their receivables ABC Company Income Statement For the years ended December 31, 2002 & December 31,2003 12/31/2002 12/31/2003 Sales COGS Gross Profit S & G Exp Depreciation EBIT Interest EBT 5,000,000 4,250,000 750,000 500,000 50,000 200,000 25,000 175,000 0 5,500,000 4,675,000 825,000 550,000 75,000 200,000 20,000 180,000 (150,000) Gain /Loss on sale of Assets Taxes EAT Dividends 70,000 105,000 1,000 12,000 18,000 1,000 ABC Company Balance Sheet Current Assets: Cash AIR Inventory Total Current Assets 125,000 225,000 100000 450,000 25,000 675,000 150000 850,000 Net Plant & Equipment 500,000 450,000 Total Assets 950,000 1,300,000 Current Liabilities AIP Accrued Expenses Total Current Liabilities 200,000 100000 300,000 250,000 S000n 300,000 Longterm Liabilities 325,000 558,000 Total Liabilities 625,000 858,000 Stockholders Equity Common Stock Capital in excess of Par Retained Earnings 0,000 65,000 250 000 325,000 30,000 145,000 267 000 442,000 Total Stockholders Equity Total Liabilties & Stockholders Equity 950,000 1,300,000 4) Given the following information, please answer the following for the '02 & '03 years As a given, assume the company extends 15 day terms on receivables and the industry median for Profit margin is 2% ; for current ratio is 1.5x Use ratios to support your answers (a) If one of the bank covenants requires a maximum Debt/Equity ratio of 2x; were they in compliance for the 03 year. If so how much more could they borrow. (b) How long does it take for the company to collect their receivables ABC Company Income Statement For the years ended December 31, 2002 & December 31,2003 12/31/2002 12/31/2003 Sales COGS Gross Profit S & G Exp Depreciation EBIT Interest EBT 5,000,000 4,250,000 750,000 500,000 50,000 200,000 25,000 175,000 0 5,500,000 4,675,000 825,000 550,000 75,000 200,000 20,000 180,000 (150,000) Gain /Loss on sale of Assets Taxes EAT Dividends 70,000 105,000 1,000 12,000 18,000 1,000 ABC Company Balance Sheet Current Assets: Cash AIR Inventory Total Current Assets 125,000 225,000 100000 450,000 25,000 675,000 150000 850,000 Net Plant & Equipment 500,000 450,000 Total Assets 950,000 1,300,000 Current Liabilities AIP Accrued Expenses Total Current Liabilities 200,000 100000 300,000 250,000 S000n 300,000 Longterm Liabilities 325,000 558,000 Total Liabilities 625,000 858,000 Stockholders Equity Common Stock Capital in excess of Par Retained Earnings 0,000 65,000 250 000 325,000 30,000 145,000 267 000 442,000 Total Stockholders Equity Total Liabilties & Stockholders Equity 950,000 1,300,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts